Private equity firms are seldom sued for their practice of levering companies for fun and profit and not caring much if they leave smoldering wreckage in their wake. One big reason has been that it takes a lot of time and effort to prove fraudulent conveyance, which is layperson terms means continuing to bleed cash out of a company into your own pocket when you know it is a goner. And to discourage these suits, private equity general partners go into the legal version of scorched earth mode to deter other bankruptcy victims from getting bright ideas.

Today, the Wall Street Journal reports on the outburst of litigation over bankruptcy restructuring plans for private-equity-damaged retailers like Payless Cashways. We’ve discussed how private equity set many retailers up for failure by selling off their real estate at rich, asin inflated prices, giving themselves a nice big payout, and saddling the operator with high lease payments. Mind you, the reason these chains had owned their own stores in the first place was that retail is a cyclical business. Owning a lot of the property you used was a way to reduce overheads and increase odds of survival.

But in the cases the Journal highlighted, the private equity owners resorted to a strategy that had been discredited, that of the so-called dividend recap. The poster child was when Clayton & Dublier acquired Hertz in 2006, loaded it with debt, and made a big dividend payment with the proceeds. While Hertz didn’t fail, the company unquestionably suffered and the recap got a great deal of bad press. Deal watchers add to the list of firms hurt by older dividend recaps, such as Hexion Specialty Chemical, Burger King, KB Toys, Warner Music, and Burlington Coat, to the degree that law firms started against the practice. From a 2006 article:

Lately, a number of companies owned by private equity funds end up in the bankruptcy courts or are left in questionable states of solvency after a dividend recap. Dividend recaps have drawn fire from institutional investors, analysts, the media and legislators who charge that private equity funds are piling too much debt on the backs of portfolio companies without considering the companies’ financial well-being. Also increasing is litigation charging private equity sponsors with breach of fiduciary duty, fraud, self-dealing, acting to deepen the insolvency of a portfolio company, fraudulent conveyance and other fiscal malfeasance following the bankruptcy of a portfolio company involved in a dividend recap.

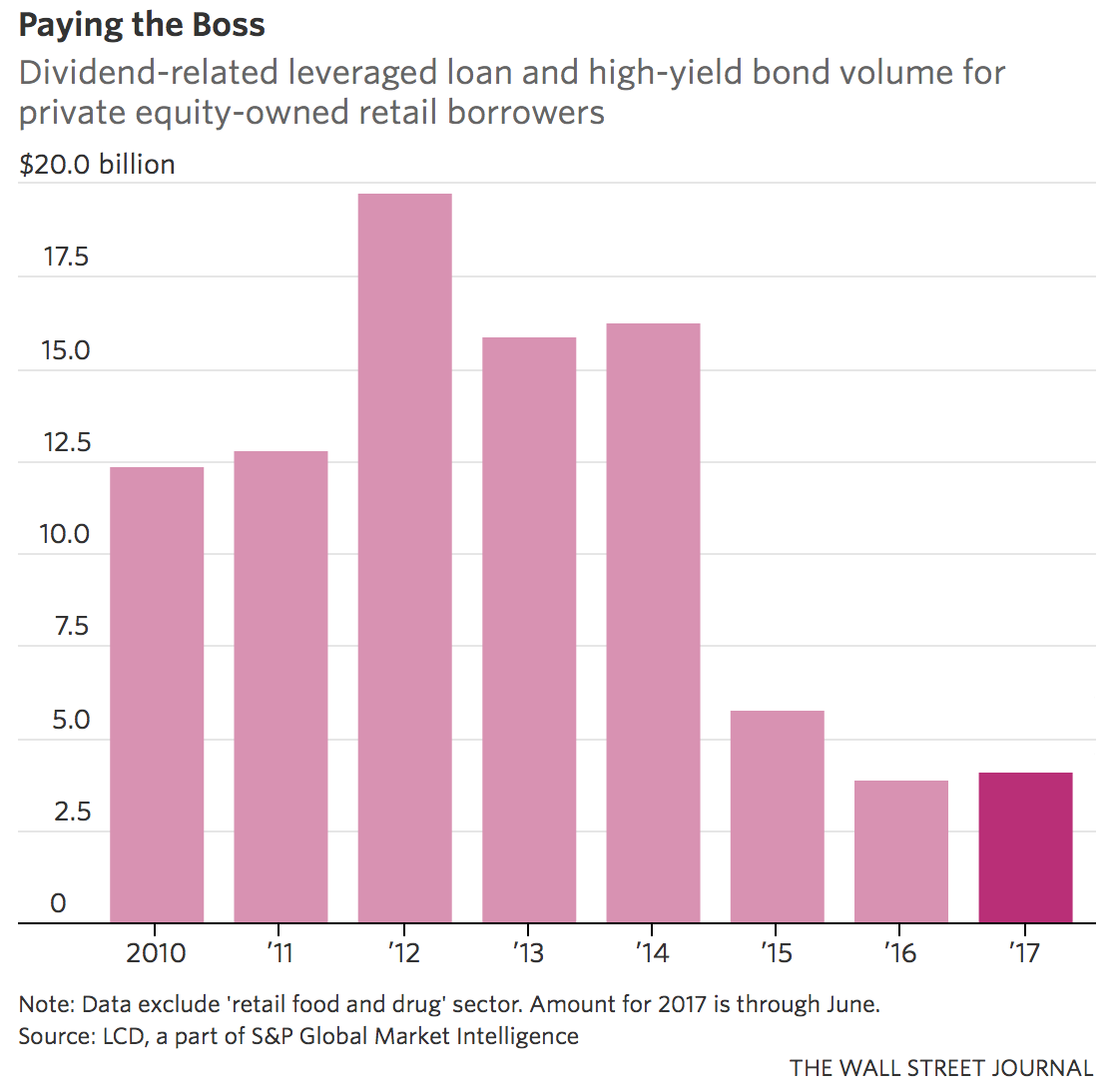

Yet in the post-crisis super low interest rate interest environment, lenders were desperate for yield and private equity firms revived this dodgy practice, as this chart shows:

A wave of retail bankruptcies washing through court has revived an old debate about the role of private-equity firms in accelerating the problems of companies in distress.

Payless ShoeSource Inc., Gymboree Corp., rue21 Inc. and True Religion Apparel Inc. were all acquired by private-equity firms during the past decade. Now, lawyers for creditors have questioned whether private-equity firms share blame for the retailers’ financial collapse, in some cases by loading debt on the companies.

In the case of Payless, investors Golden Gate Capital and Blum Capital, after a leveraged buyout in 2012, over the next two years paid themselves $350 million in dividends—in total putting more than $700 million in debt on the company. In 2016, Payless said in court papers, it had about $2.3 billion in global net sales, and nearly $840 million in debt…

Gymboree’s June bankruptcy filing occurred days after it couldn’t make a semiannual interest payment on debt dating back to Bain Capital’s $1.8 billion 2010 buyout. Public filings show Bain also received fees from Gymboree in the years after the buyout.

Earlier this month, Gymboree’s unsecured creditors, including vendors and landlords owed an estimated $220 million, said in court papers they have been investigating potential claims against Bain and other insiders. The creditors, which are slated to receive nothing, point to dividends and fees received by Bain and its affiliates….

True Religion filed for chapter 11 protection in early July. Shortly after, a junior debt lender, Ares Management LP, raised concerns about the proposed restructuring plan, which will leave the creditor with a slim recovery while private-equity backer TowerBrook Capital Partners LP is slated to receive the same or higher return as Ares. Typically in bankruptcy, lenders expect to be paid before equity owners….

For Payless’s creditors, the tactic of raising their voice in court paid off, to an extent. Following heated exchanges in filings and in the courtroom, as well as private negotiations, the private-equity backers and lenders have agreed to give more than $20 million to the company, which will be used toward beefing up the creditors’ recoveries. Meanwhile, the creditors have agreed not to bring any legal claims against the backers following the bankruptcy filing.

But as Bloomberg pointed out last week, some of the legal maneuvering at Payless looks pretty sus:

Payless, remember, is the discount shoe retailer that became insolvent earlier this year after being the subject of a leveraged buyout in 2012. Now, suppliers and property owners that are owed money are clearly mad about how private equity firms directed Payless to borrow millions of dollars to pay themselves hefty dividends without improving the company’s viability.These creditors want to hire an expert to evaluate how much those dividend payments ate into Payless’s value and doomed its fate.

Here’s where the case goes down the rabbit hole: Payless, which is still owned by private equity firms Golden Gate Capital and Blum Capital, responded this week by saying it’s already investigating the dividend payments. The probe is being headed by Charles Cremens, who’s affiliated with another private equity firm, Bunker Hill Capital. Payless argues that hiring a separate team would be redundant.

That’s right, someone close to private equity is investigating private equity firms for doing a very private equity thing. This throws off a vibe that perhaps this investigation isn’t the most independent one. The unsecured creditor group obviously shares that view in its desire to spend the time and money to bring on someone with a bit more of an outsider perspective….

A good start would be to not have private equity investigate its own complicity in excessive, debt-fueled dividend payments. It clearly didn’t help Payless to have so much debt piled on top of it. It would be helpful to avoid a repeat.

In a sign of a bit of a shift in the zeitgeist, the comments on the Wall Street Journal, which typically favor big rich dogs, were on the whole critical of the private equity machinations, with quite a few also saying this sort of thing was hardly new. For instance:

ARTHUR PICCOLO

In our society it is the typical way private equity firms make lots of money risk free while undermining other companies and handicapping our society for their very greedy gain. And they are even lionized for doing so and making themselves super-rich by doing nothing but manipulating our financial and legal system. God bless America’s oligarchs.Mark Lynn

What about J Crew, Nieman Marcus, and Nine West. All hobbled under the stewardship of private equity……Stan Kabala

It is really hard to feel sorry for a company like Ares ($ 4 Billion market cap) that most likely purchased this debt at deeply discounted prices to get high yield. They are sophisticated investors trying to increase their yield by getting a larger share of a diminished pie.The losers here are employees and mall owners who lost jobs and lease payments respectively (possibly suppliers too). Mall owners are losing a lot more than the businesses that go bankrupt and also are sophisticated investors. Retail employees seem to be “collateral damage” in the high stakes battles among the investors of all stripes. Same story, different day.

And even the people who defended private equity and said the fault lay with stupid lenders sometimes got replies of the sort “No, it was the Fed’s fault” For instance; “Zero interest rates have ‘investors’ throwing money at anything that moves.”

Indeed, the more visible private equity becomes, despite its great efforts at maintaining its secrecy, the more even the better heeled members of the great unwashed public don’t like a lot of what they see. Bloomberg’s Noah Smith felt compelled to pen a piece last week, Private Equity Doesn’t Deserve Its Bad Reputation, which despite the tone of the headline and the cheap trick of counterposing a critical book by a mere journalist (Josh Kosman, whose Buyout of America is very well documented) against a handful of academic studies still failed to a compelling defense. And that’s before you get to the fact that Smith ignored the ignoring the exhaustive, rigorous treatment of private equity by Eileen Appelbaum and Rosemary Batt in their landmark book, Private Equity at Work, as well as their research since then, and also oddly failed to mention that the academics he touted regularly consult to private equity firms.

So private equity is staring to lose its largely undeserved sheen. This is a necessary but not sufficient precondition for curbing its excessive influence.

you want to see REALLY egregious, Yves. Go look at the bankruptcy case of Adeptus Health and read the motions to form an equity holders committee and then the motion to appoint a chapter 11 Trustee. It looks like these folks are moving in to new targets.

Not dissimilar to property developer/businessman Phillip Green’s tactics in Britain in his retailing career that involved transferring ownership of acquired retailing chain properties. After he acquired the British Home Stores chain he borrowed 1.2 bn pounds which he used to pay his wife a special dividend – incidentally she is resident in the tax haven of Monaco. He subsequently sold the chain that then collapsed with huge pension liabilities that leave former employees destitute. He spends his millions on massive yachts, huge show off birthday parties for himself and family and bar mitzvahs for his sons.

(He is/was Sir Phillip Green but there were moves to ‘punish’ him by withdrawing the knighthood. What a joke)

Levering up the companies to the max, and earnings to near zero, also results in a taxpayer financed boondoggle, if these firms ever paid taxes to begin with.

If Noah Smith could be a fly on the wall overhearing these PE guys talking shop and strategies (maybe he could go under-cover as a waiter at Nobu?) I suspect he would retract his article.

Re a Noah Smith retraction:

Noah Smith has a blog and has written such postings as “We do not need an immigration pause (February 7, 2017) and “On why liberals should own guns (February 18, 2017) so one might suspect he tends to be more business friendly and conservative.

Per the Bloomberg View bio, Noah Smith is a former academic “was an assistant professor of finance” and now is a blogger and Bloomberg View columnist.

We may be seeing some brand building by Noah Smith as he attempts to get more noticed by TPTB in business media.

However, a semi-retraction might be another opportunity for Noah Smith brand building.

You’re assuming the article was a dispassionate gathering of evidence, which would be corrected if only he’d seen the real evidence. His conclusion was written before he even started researching the piece.

For CA residents interest, “Here’s where the case goes down the rabbit hole: Payless, which is still owned by private equity firms Golden Gate Capital and Blum Capital, responded this week by saying it’s already investigating the dividend payments.”

A Blum capital principal is Richard Blum, the husband of CA “moderate” neocon/neolib Senator Dianne Feinstein.

As I’ve mentioned before, if liberal Democratic bastion San Francisco produces such politicians as Feinstein, Kamala Harris and Nancy Pelosi, it is yet more evidence to explain why there is a “hope deficit” in the USA

Furthermore, they are all “glass ceiling” breakers..

California readers, please take note. Dianne Feinstein already has six primary opponents:

https://en.wikipedia.org/wiki/United_States_Senate_election_in_California,_2018#Declared

A bunch of links to Feinstein’s opponents’ web sites:

https://en.wikipedia.org/wiki/United_States_Senate_election_in_California,_2018#External_links

Pelosi also has a primary opponent:

https://jaffe4congress.com/

The voters in California can do something about the phonies in Congress, but it will take effort. Be sure that you are registered as a Democrat, so you can vote against Feinstein (and against Pelosi, if you are in her district) in the primary.

Thanks to john wright for id’ing blum, and to vatch for consistent actionable details

Hope – to want something to happen or be true

I would propose that their is a “hope surplus” in the USA. Too many people wanting something to happen but unwilling to make the effort it will take.

“Be the change that you wish to see in the world” – Mahatma Gandhi

For most activists, the system has already beat the hope out of them. Just look at the NoDAPL protestors: locked up, roughed up, shot, sued, etc.

Mahatma Gandhi (and I know I will get backlash for this, but it is the truth afterall) slept with 12 year old girls as part of his “religion”. And it’s a whole lot easier to rally up a rebellion when your homeland has been invaded by foreigners. In the US, the invasion is from Wall Street, and they look like everyone else…

My hope is that America doubles down on its stupid, allows for more consolidation, more monopoly, less freedoms, higher taxes, doesn’t fix the infrastructure, etc. The revolution will need all of the above to happen for American’s to stop watching TV and the Kardashians and actually do something about it.

Until then though….

Yeah, but usually when someone “sleeps” with someone else, there’s more than just sleeping going on. In Gandhi’s case, it really was only sleeping. It was intended to be a test of chastity, which seems kind of weird to me, but it’s not nearly as bad as it could have been.

And Thomas Jefferson raped his slaves, Churchill was an alcoholic, Einstein cheated on his wife, etc.

The words and ideas of historic figures are what makes them respected. Making them out to be saints free of personal flaws and failings, and judging them as such, strikes me as puerile.

John,

I love your comment. Feinstein is a true glass ceiling breaker or there is not top to how much her political power can give to her hubby’s economic power and vice versa . I wish I could find an outstanding 1990s article I read on the Feinstein-Blum partnership.

It is not the link you are looking for, but this Glenn Greenwald opinion piece from 2007 covers a lot of Dianne Feinstein’s political history after 9-11.

http://www.salon.com/2007/09/23/feinstein/

Here is a quote:

“Most of these political officials who feed off of Washington year after year become appendages of it and vigorous defenders of nothing other than the Beltway system. They are drained of all belief, conviction and passion. And in Feinstein’s case, it is particularly easy to understand why this is so. Her current husband, Richard Blum, is an extremely rich defense contractor whose companies have endless relationships with the work Feinstein does in the Senate. It is entirely unsurprising that Feinstein’s affection is reserved for officials in the intelligence and defense communities because those are her social peers, the individuals with whom her husband interacts professionally and socially and with whom she most identifies.”

Here some information from https://en.wikipedia.org/wiki/Dianne_Feinstein

“Feinstein was criticized in 2009 when she introduced a bill directing $25 billion to the FDIC the day after the agency awarded her husband’s company a contract to sell foreclosed properties at compensation rates higher than the industry norms. Feinstein and her husband have been tied to questionable dealings between the world’s largest commercial real estate firm and the U.S. Postal Service.Feinstein has also been accused of abusing her position to award her husband’s companies billions of dollars in military contracts.”

One could believe the CA Republicans usually fail to run a decent candidate against her BECAUSE Feinstein is very effective at doing what the Republicans want anyway.

One can hope that Feinstein wants to “spend more time with her family” and decides not to run again.

But around NC, hope is in short supply.

I am baffled. I thought these practices were the whole point of Private Equity. It is preferable to be privately instead of publicly owned where there would be actual scrutiny. If you can’t rape and pillage the debt-holders and employees, then it would require real management skills to turn the companies around so that the share prices would increase in value. That actually requires some elbow grease.

Feinstein wants to run again! :((

The LA Times has an opinion by Harold Meyerson today about why she should not. Many Californians could list out various reasons why she should just retire, already. I’d vote against her just for the Blum factor, as if I needed any others!

Another PE/Hedge Fund strategy that fraudulently sells off company real estate to give owners a big payout before bankruptcy is ‘sale leasebacks’. In this transaction, a PE or Hedge Fund identifies valuable real estate owned by a heavily indebted company near bankruptcy. They buy this valuable real estate for pennies on the dollar because it is leased back to the company for everyday use at a deeply discounted rent (valuing the purchase price as net present value of future lease cashflows). The company therefore sells its assets to the PE/Hedge Fund at a deep discount, because it leases it back at a deeply discounted rent. When the company collapses soon after this deal, the PE/Hedge Fund can then sell or rent this property at full market value, making windfall profits while all other company creditors fight over what assets are left.

I think this is currently in process at Sears. According to Forbes “Sears still occupies 90% of properties rented by SRG (Seritage Growth)…..Every property Sears vacates simply gets rented for 4x as much…..In the last year, SRG rented over 2 million square feet at 4.5x what Sears was paying them. Just 10% non-Sears rented space accounted for 31% SRG revenue. So SRG needs to rent 25-30% of its rental portfolio at the current rates to more than make up for Sears going bankrupt.”

https://www.forbes.com/sites/kenkam/2017/04/12/a-reit-that-warren-buffett-likes-seritage-growth-properties/

I’m sure many vultures will be collecting huge profits when this retailer files for bankruptcy.

Thank you for that information, Jim Tan. I knew that a Hedge Fund had invested in Sears and I was suspicious that the HF might be the reason that the bonuses went to the executives while the employees had their pensions and severance cast into limbo! Such an outrage.

I see your point. It would be the executives who would have to sign off on that kind of creepy sale/leaseback deal. They’d have to be given a reason.

It occurs to me that this piece complements Sandwichman’s machinery post. Leveraged buyouts are indeed a very specific type of capitalist “innovation,” but the end result is the same: assets that have been created collectively are, via innovation, appropriated entirely by capitalist “owners.” Sure, there is some collateral damage to other capitalists (but for many of the latter, this is simply a normal risk of doing business). But the real losers are the employees and the local commerce “ecosystem” (not that I am a big fan of shopping malls).

I think most NC readers understand the problem; have understood the problem since 2008-9. Unfortunately, politicians seem simple-minded, binary thinkers: money/no-money, power/no-power. The politicians control the regulatory machinery. Nor do politicians understand the polity’s elan and esprit. Politicians can only club down the esprit with words like “deplorable”. Politicians are in thrall to big money and the rationalizations of economists, those wholly-owned subsidiaries of big money.

Productivity is dropping? Not to worry. Life-spans are shortening? Not to worry. Houses and cars are being stolen to benefit a private few? Not to worry. Good corporations are being dismembered for the private gain of few? Not to worry. The work and savings of employees’ lifetimes is being stolen to benefit a private few? Not to worry. The corporate skill and competence and vigor of the country is being wasted to benefit a private few? Not to worry. Trump is in the White House? Not to worry.

As long as money flows to the politicians they will look the other way. Until, that is, money is no longer enough to manage power relations, as in the 1930’s. 70-80 years is about the time span of forgetting.

This comment is tendentious, I know, but I can’t any longer believe the political establishment would change things “if only they knew”. They know the current arrangement pays them very well. If it hollows out the country, well, gosh, too bad and all, but it pays so well. Economists assure them it’s OK for them to be ‘economic men’. The current political establishment is part of the problem, not the solution, imo.

Thanks for this post.

shorter: ‘What profit it a politician if he gain the whole world, and China eats his lunch?’ (paraphrasing ;) )

So, the Beta for PE/Hedge funds doing such asset stripping is litigation. Give the lucre involved, I’d bet they’ve got some high power law firms working for them, with a willingness to bleed to death anyone foolish enough to take them on. Wake me when they lose.