By Yves Smith and Tom Adams, an attorney and former monoline executive

The Fed and its friends and enablers in power, most recently Rahm Emanuel, are fighting tooth and nail to beat back the Audit the Fed amendments to pending financial reform legislation.

That’s unfortunate and misguided. Even a cursory inspection of the Fed’s disclosures of its extraordinary rescue operations shows them to have been made only under duress, and then to be incomplete and deliberately unhelpful.

The reason this matters, is that, contrary to the Fed’s claims of independence, it has been operating as an extra-legal off balance sheet entity of the Treasury, circumventing normal Constitutionally-stipulated budget processes. And rather than make adjustments in its practices to reflect its enlarged and now overtly political role, the Fed has instead been engaging in cynical, blatant misrepresentation, giving lip service to the idea of greater transparency in public, while fighting disclosure tooth and nail.

Since the Fed has entered into an openly political stance (and this dates back to Greenspan) and cannot be relied upon to make truthful and complete disclosures, the only recourse is to put it on a much shorter leash, which includes greater scrutiny, including third party validation. The Fed has brought on the audit demands via the unabashed and repeated abuse of its privileged role.

The case study is its Maiden Lane disclosures. Readers may recall that the original Maiden Lane was a new entity formed to hold dodgy Bear Stearns assets, a backstop to induce JP Morgan to take the balance of the failed investment bank. JPM took a thin first loss position; the bulk of the capital came via a loan from the Fed, which means the Fed would lose money if losses exceeded the JP Morgan slice, which was a mere $1.15 billion out of $30 billion. Even though the backdoor subsidy to JP Morgan elicited a great deal of criticism, even from the normally taciturn Paul Volcker, the Fed was apparently so pleased with this idea that it used the same approach with AIG. The central bank created Maiden Lane II to hold dubious AIG mortgage assets, and Maiden Lane III for CDOs (alert readers may recall that Maiden Lane III was part of the mechanism that the New York Fed used to take various dealers that had credit default swap exposures to the Fed out at 100 cents on the dollar). All these vehicles are managed by BlackRock.

The Fed, aided and abetted by BlackRock, has long been publishing rosy valuations of the assets of the various Maiden Lane vehicles. Accuracy of valuation matters for a host of reasons. First, the public has a right to know how large the various government subsidies to the banking industry are, irrespective of Fed and Treasury efforts to camouflage them. Second, losses on the Fed’s accumulation of dreck may well rise to the level that it will require Treasury (meaning taxpayer) recapitalization of the Fed (the central bank can in theory “print” its way out of any shortfall, but as former central banker, now Citigroup chief economist Willem Buiter has pointed out, the Fed’s anti inflation mandate puts limits on how far it can go down that path). Third, this willingness to bend facts reveals troublingly cavalier attitude from a bank regulator. If the Fed thinks fudging its own marks is OK, it is likely to be unduly tolerant of truth-bending by the institutions it supervises.

Our own look at Maiden Lane III at the end of last year suggested the valuations were too high, but without more disclosure, we couldn’t reach any hard and fast conclusions. The Fed seems to be raising artful dodging to an art form, engaging in the form of disclosure when it fact is it simply providing impressive-looking data that is virtually useless from an analytical perspective.

Let’s look at a simple example. The Fed provided a juicy-looking list of the transactions in Maiden Lane, the Bear bailout vehicle. It would be nice to spot check some of the valuations, particularly since the portfolio was exposed to hotels (82.3% of the CMBS were “hospitality”). Hotels, unless they are in very prime locations, tend to be worth a lot less dead than alive. They are often built for particular hotel chains, and if that operator gets in trouble, the options for disposition of the asset are limited. The building may have no value to other users and has to be razed, leading to serious losses to lenders.

Now the Fed does report impaired assets for Maiden Lane, and it appears to mark them down aggressively (the year end report shows non-performing assets at 13.5% of par value) but it simultaneously appears to have gotten more liberal as to when it deems an asset to be non-performing:

In 2009 the LLC changed its classification of Non performing / Nonaccrual loans to include loans with payments past due greater than 90 days or when the LLC has doubts about the future performance of the loan assets. The prior year presentation disclosed all loans greater than 60 days past due. This change in presentation was made to conform with industry standards and did not have a material effect on the LLC’s consolidated financial statements.

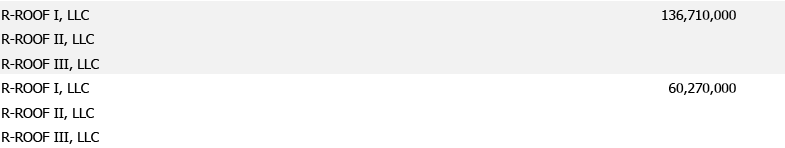

Hhhm. It might be nice to see how Maiden Lane is carrying particular impaired assets. A recent Wall Street Journal story tells us a lot of hotels are in trouble right now. In particular, Red Roof Inns has had delinquencies since last June, plenty of time for it to be picked up in the 1/29/10 transaction level reports just released. But what do we see? Click to enlarge; see p. 21):

Now why is this significant? The values here foot with that of a prospectus on the “RRI Hotel Portfolio” prepared by Bear Stearns. From page d-14:

The Loan. The third largest loan (the “RRI Hotel Portfolio Loan”) is a $186,000,000 pari passu portion of a $465,000,000 first mortgage secured by the borrowers’ fee interests and leasehold interests in 79 Red Roof Inn hotels (the “RRI Hotel Portfolio Properties”)….

The Borrowers. The borrowers, R-Roof I LLC, R-Roof II LLC and R-Roof III LLC, each a Delaware limited liability company, are single purpose entities, each with an independent director, that own no material assets other than its respective properties in the RRI

Yves here. So what did the Fed give us? The stupid par value of the loans. We have no idea, nada, of the current carrying value. So there is no way for third parties to inspect the reasonableness of the marks. The reported non-performing commercial balance is well in excess ($1.1 billion) than the par value of the Red Roof loans. So there is more junk in there, but which deals? And are the values plausible?

The central bank’s Maiden Lane disclosure is a prime example of adhering to the form of disclosure while giving as little ground as possible on the substance. It’s a certainty that BlackRock’s reports to the Fed are more transparent and informative. We have pages of “HTL” entries with no balances (so if there are no assets, why are they listed?) and some isolated entries with amounts indicated, like the remarkably informative “HTL OWNED MEZZ I-II LLC” with a $22.932 million balance (p. 14).

But the real fun starts on p. 87 (of 131) with “Swaps and Hedges”. If mystery hotels were entertaining, imagine what a party mystery credit default swaps are. BlackRock can say these instruments are worth whatever it bloody pleases, and who in the chump public will be the wiser?

The Fed seems awfully keen to steer clear of the fate that befell Lehman. Lehman was grossly and verifiably misvaluing some investments, namely Archstone and SunCal, that confirmed doubts about the veracity of its accounting. If you can’t check any particular valuations, it’s a lot harder to ask difficult questions. And unlike Lehman, the Fed can continue to account to no one.

The Fed is engaging in same practices that caused the crisis: failure to make timely disclosures, obfuscation, use of off balance sheet vehicles to distance itself from losses. This posture alone should disqualify the central bank from assuming a greater regulatory role.

The Fed and Treasury’s three card monte operation is anti-democratic and possibly illegal, and to add insult to injury, voters are treated as if they have no right to know when they are ultimately footing the bill. The Fed’s persistent stonewalling and deep seated hostility toward the public provide ample proof of the need for an audit.

It’s important to fight back against the Status Quo Lie, so beloved of the MSM, that the Fed is “independent”, non-political, non-ideological, that its actions comprise some natural, objective baseline, while a measure like a Fed audit would be a “political” intrusion upon this “independence”.

The fact, as this piece says, is that at least since Greenspan the Fed is aggressively political, radically ideological, completely dependent and appending from its Wall Street master. Any public interest measure like a real audit would actually be restoring a less ideological state of affairs, as according to the public proclamations of even this government, this is supposed to be a democracy, and public institutions are supposed to work for the public interest.

A true, rigorous audit can only help toward both of those ends. (While, as we discussed in yesterday’s Greenspan post, all the actions of these criminals, including their resistance to an audit and their lying propaganda against it, prove their ideological extremism and in particular their hatred of democracy and the public interest.)

The Fed reported a 58b profit last year. Largely from the positive carry of its big holdings of Agency MBS.

So Ben B had the income to write down the assets.Failure to have reserved properly will haunt him if in fact the marks are no good.

Why in heavens name would Ben have done this? Oblivious?

Thank you Yves for your analysis and very important work. The hostility is only exceeded by contempt of the public.

Incentives do count. The world is upside down when the prudent, responsible and virtuous are literally punished. A credit based economy cannot stand unless debts are recognized so the public can make prudent and objective choices. Free markets?…uh-huh.

Agree with this comment.

But it underscores a current mystery: why would the WH be using so many resources to prevent the Fed from being audited?

The WH stance is incredibly suspicious.

I sense this is one of those ‘lose-lose’ moments:

Lose – if the Fed is audited and the level of fraud is made visible,

LoseEvenBigger – if the Fed is not audited, because the levels of public distrust will rise to new levels not seen before. It’s a political Katrina.

I meant to say that in view of the content of your post, it’s incredibly suspicious that the WH is so intent on protecting the Fed. It lends a great deal of credence to this post.

It makes the WH appear to be in collusion on trying to continue hiding fraud. How that translates to public support is baffling; do they think people will never figure this out? If so, they are dreaming.

My theory is that the Fed audit would reveal larger committments to foreign creditors such as China that cannot be kept. Does China and the rest of the world really have $14 T to play with? Of course not.

Restructuring with foreign creditors would be the next step and I do not believe they would see any reason to play ball. Default either silent or direct will lead to geopolitical consequences in the form of military misadventure. Is there anything new under the sun?

What if the FED is buying more treasuries than they’re admitting? That would be scary huh?

“Assets?…. We don’t got to show you no stinkin’ assets!”

As a mild libertarian, I have had to confront some very uncomfortable truths about my world view (dare I quote Greenspan, “there was a flaw in my ideology”).

But here is the flaw in the view that more legal/regulatory stuff is our salvation. Laws are already not being enforced “circumventing normal Constitutionally-stipulated budget processes” – indeed, the supreme law. And this is under what is viewed as the good government auspices of the Democrats.

“The Fed is engaging in same practices that caused the crisis…”

Why is that? Does the Fed believe that the problem is solely pessimistic thoughts, and if only people would believe those assets are worth what they say they are, everything goes back to 2006?

Our representatives were not imposed upon us by Martians (despite Steven Hawkings, would extra terrestials give us a worse Congress? – if so, we should indeed fear extra planetary contact) – the laws, rules, and finally, our willingness to look at difficult truths is due to ourselves, not our stars.

You can get carried away with this blaming-yourself business. That’s a corollary of all this democracy bullshit (when Obama says democracy, he means what Bush meant by freedom: that is, some ineffable personal quality you have despite your subjection to kleptocracy, secret laws, incommunicado detention, extrajudicial killings, dynastic rule, electoral fraud, and a brutal police state shitting all over jus cogens.) Maybe this overreaching state is really what you want, like you say, but if you didn’t want it you would sure as shit get it anyway. This state is out of control. So don’t beat yourself up about it.

I agree with every word here.

great investigative work

I am not sophisticated in this issues, so perhaps this is a very stupid question — but would it make sense (and be more politically palatable) to press for an audit of everything BUT the Fed’s monetary policy work? I can see arguments in favor of not auditing the latter, but maybe I am being naive. Any thoughts?

The solution to this systemic meltdown is to hold all rating agencies, accounting firms and insurance agencies accountable for all the trillions in losses during the last 5 years — then, after they are all 100% bankrupt, re-invent risk analysis starting with the Fed, Treasury, DOJ, FBI, SEC, FTC and make fraud into a real crime, which has lethal consequences. This would obviously run Buffett out of business and all the IBs….. and place many current government employees in Fed prisons.

The Fed asserts that it needs secrecy in order to prevent bank runs. In some respects a rational point of view, especially when we have a fractional reserve system.

That rational collapses when it is used to hide transactions that have the affect of abeting a fraud. That is, an enterprise that executes a contract that it cannot honor is, in my view, perpetrating a fraud.

The scary point is HOW LONG they think they need secrecy to prevent bank runs. That’s the variable that isn’t really being discussed and tells a big story on its own. TIME. We’re two years out and secrecy is being maintained. That tells me what I needed to know.

“The Fed and Treasury’s three card monte operation is anti-democratic and possibly illegal”

Under 13-3, is it possible to for the Fed to do anything “illegal”? It seems to me the Fed is Nixonian under 13-3, if the Fed does it, it’s not illegal

Yep. TARP has always been.. purely theater and political cover. The way politicians, press and even commercials exploit the disjointed logic of TARP “payback” is pure mendacity. The FED dragged Congress into their game. Congress fell for it.

“Stalinism is associated with a regime of terror and totalitarian rule.” [1] Stalinism, when used in its common derogatory sense, refers to self-proclaimed socialist states that use secret police, propaganda, and bureaucratic central planning of the economy, to enforce their rule.

* http://en.wikipedia.org/wiki/Stalinism

“We run the risk, by laying out the pros and cons of a particular argument, of inducing people to join in on the debate, and in this regard it is possible to lose control of a process that only we fully understand.”

I was going to look for this quote by Greenspan from 2004 on the web but see that Yves helpfully has it a few posts below. It explains the Fed’s opposition to an audit and transparency. Bernanke, Obama, don’t want to lose their hold over the Fed. They don’t want to be bothered with justifying their decisions. They especially don’t want how bad those decisions were to be exposed. They are doing it to cover their own complicity in the fraud that the banking system has become. It is about extend and pretend. Audit the Fed and the underlying insolvency of the whole system would come to light. That would necessitate real reform, deep restructuring. Can’t have that.

I’ve been hearing “no one understands but us” for too long now from all the same circles. Opacity and arrogance is a dangerous combination. Plenty of people know finance better than the GS employee who was selling it. This isn’t a problem of no one knowing, it’s a problem of those who think they know.

I’ve got this gnawing feeling that the entire fraudulent financial system is about to unravel, all the way up to the FED level…

And it’s not gonna be pretty…

Audit the FED? Get them the hell out. Abolish the FED. When they fall, it all falls.

If you want respect for the laws, make respectable laws. Brandeis said that and this country has no respect for the law or respectable laws anymore, and it shows. Fraud and corruption everywhere at the top and nobody with the guts or conscience to call a halt to it.

And now, they are for sure throwing the baby out with the bathwater, all for a few more bucks for themselves.

Abolish the FED, get every last man and woman out of office and start fresh.

and that still means nothing. Abolish the FED, who cares. They aren’t even the power in banking.

You don’t get it at all.

FWIW, the housing bubble was already getting going BEFORE 00 was out. The money was already fleeing hte NASDAQ and moving into RE. However the offshoring boom flew to a higher level than expected, which was the true trigger for the 01 recession. The bankers biggest crime was trying to think of “innovative” ways to keep the investment money coming in and then trying to profit off of it. But that is what bankers do, and why they need such tough oversight.

I just hope PBS continues to have you on their show. Those liberal idiots are dangerous. America is so wildly misled. Thanks for your insights.

Americas bumper sticker..The Future is NOW!…

Followed by…Till there is NO Future, too Suck off in the NOW!

Skippy…every time we consume something, we diminish it’s potential in the future, for those in the future…ah but technology will fix that right[?] or is that another case of bringing the future forward again….at least in thought…umm?

PS…new national anthem: http://www.youtube.com/watch?v=kf4eu5y0418&feature=related

Lifted from comments: in BP, Walmart, Monsanto, and Goldman Sachs We Trust!

I think the FED is buying more treasuires than they’re admitting. Interest rates going down right noe makes absolutely no sense at all.

The most depressing aspect of this cover up, is that it’ll be successful.

The reason is very simple: the MSM just won’t touch a story like this post does.

And without the MSM to wake up the unwashed masses, no public pressure.

We’re thoroughly and completely screwed. This republic won’t survive.

Great job done guys keep it up and keep rocking.

Found him on cracked.com a few months back. I check youtube every now and then for something new from him. My sister and I randomly start singing little wings all the time in a horridly shrill voice. Not to mention that producer of his looks like a fat Richie Sambora with sunglasses on. It’s hilarious.

thanks man for sharing your thoughts with us.

Reading your postings has made me very skeptical of your point of view. A couple of months ago, audit of the Fed would have seemed an obvious positive to me, but now I doubt. Arguments that rely on strange hysteria about Rahm Emanuel (Emanuel Goldstein!), Ron Paul and Daryl Issa, and tendentious accounting leaps just seem to invite disbelief.

Sorry.

FWIW, the housing bubble was already getting going BEFORE 00 was out. The money was already fleeing hte NASDAQ and moving into RE. However the offshoring boom flew to a higher level than expected, which was the true trigger for the 01 recession. The bankers biggest crime was trying to think of “innovative” ways to keep the investment money coming in and then trying to profit off of it. But that is what bankers do, and why they need such tough oversight.

I think now this gonna work it.