Cross-posted from Credit Writedowns

Just a few moments ago I posted on the fact that the US is officially in bear market territory. On Twitter, I said that “in Fall 2008, 10-year yields went to extreme lows and then the liquidity train went into overdrive. Stocks rallied, bonds fell.” I wonder if we will have a repeat now. Felix Zulauf believes so:

Once the S&P 500 falls to 1000 or below in the first half of 2012, the Fed will come in and try to support the system. Eventually the ECB [European Central Bank] will try to do the same thing in Europe. The damage in Europe will be greater, as Europe’s financial system is even weaker than the U.S.

–Zulauf: "I expect the market to go below the latest lows in September"

We should focus on the ECB this time since the crisis has now moved to Europe. My question on Twitter was “If we get on the liquidity train, what assets will central banks buy?” More specifically, what would the ECB buy? Marshall and Warren Mosler suggest that they provide a full backstop to Greece as a quid pro quo for austerity. This is not a politically feasible plan as they point out; it would work neither for those at the ECB against monetising debts nor for Greece where the economy is being crushed by the contraction that is synonymous with fiscal consolidation.

The reality, however, is that the ECB’s equity capital is €10 billion. If Greece defaults, the ECB will lose a multiple of that amount and then you run into the bankruptcy/seigniorage problem that Willem Buiter explained in a piece I highlighted over the summer:

As long as central banks don’t have significant foreign exchange-denominated liabilities or index-linked liabilities, it will always be possible for the central bank to ensure its solvency though monetary issuance (seigniorage).

However, the scale of the recourse to seigniorage required to safeguard central bank solvency may undermine price stability. In addition, there are limits to the amount of real resources the central bank can appropriate by increasing the issuance of nominal base money. For both these reasons, it may be desirable for the Treasury to recapitalise the central bank should the central bank suffer a major capital loss as a result of its lender of last resort and market maker of last resort activities.

That’s the real problem for the ECB with default, by the way; they have been buying up the dodgy assets of the euro zone, much as the Fed did in the US in 2008 and 2009. If we get defaults then you have to take credit writedowns and that makes the ECB technically insolvent.

Without full monetisation and an explicit backstop or defaults, the European Bank Run now claiming Franco-Belgian bank Dexia will continue – and get worse. Frankly, there aren’t any palatable solutions. The Europeans need to pick one, full monetisation or default and recap, and see it through. Of course, buying up Greek assets and promising to backstop Greece, preventing default at these levels, gives the ECB a serious filup from the resulting asset price appreciation. The ECB could then always let Greece default down the line without taking a hit to their capital.

As to the bear market, Andy Lees of UBS has a few thoughts this morning:

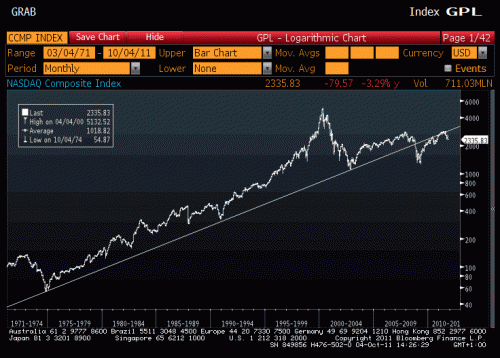

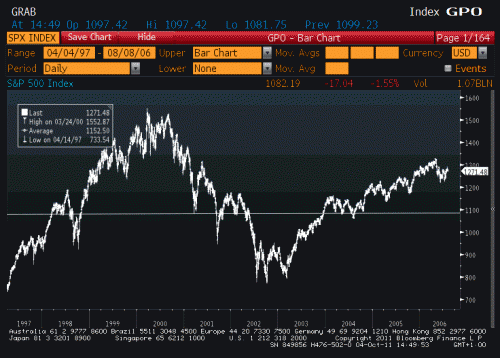

A few quick charts. The first is a long term – (post 1974) chart of the S&P. Post Lehman’s we traded aggressively below the trend that had remained in place bar the temporary dip when Mexico declared a moratorium on its debt in 1982. It has since traded back up towards the trend and is now clearly rolling over again. The chart looks extremely vulnerable in my opinion. The second chart shows a similar picture of the Nasdaq.

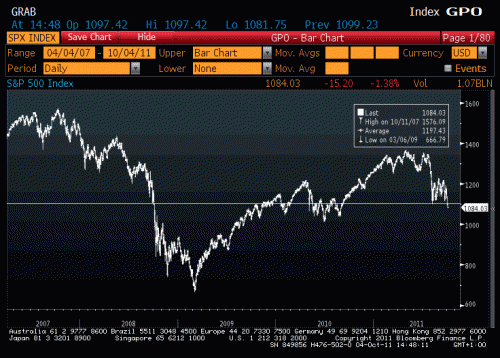

The third chart shows a much shorter dated S&P. As you can see we are at the Lehman’s convulsion point from which the S&P quickly fell 200 points before finding any support. Chart 4 shows this level was also extremely important in the Russian debt default and LTCM, falling 150 points from here before trading back to this level and repeating the whole thing again all within the matter of a couple of months. It is also the level which the market initially bottomed after the internet / telecoms bubble blew up, falling 250 points in its final throws to this level and then bouncing back again, all between February and May 2001. It is the level from which the market plunged after 9/11 and then acted as the bottom of the range from November 2001 to June 2002 when we had the accounting scandals of Enron etc, and it is from here the market plunged in June 2002 as the European insurance crisis unfolded and the market started to prepare for the Iraq war.

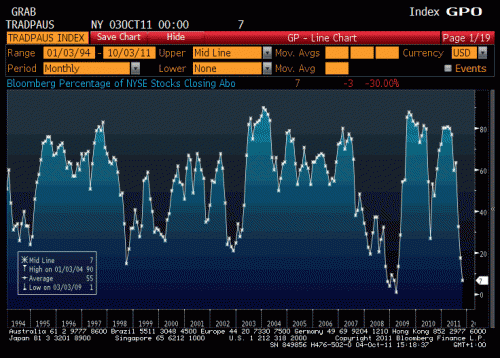

The 5th and final chart shows that just 7% of shares listed on the NYSE are still above their 200 day moving average. On the face of it this could offer some support as the previous lows did coincide roughly with the first low in 1998, a low in 2002 and obviously the 2009 low, however what the chart also highlights is that this index was at these levels or lower from October 2008 to March 2009 during which the S&P fell 30%.

The Fed, the ECB or the PBOC could bail us out, but to me these charts are suggesting that we are likely to see a further sharp deterioration in the short term.

At which point on the chart does Washington run out of excuses for not putting TBTF Zombie banks in receivership?

Please God let this be the crisis to finally break the grip of the TBTFs.

Yes please!

A-men!

not a chance…because the tbtf’s are the agents of the extraction machine funded by the fed…no one has enough power to root them out…except you and me…

and ‘washington’ is their agent so you can see that it will not happen

At which point on the chart does Washington run out of excuses for not putting TBTF Zombie banks in receivership?

Please God let this be the crisis to finally break the grip of the TBTFs.

I’m all for this (in fact, I believe it’s inevitable), but I hope you realize that the general economy is going to experience a hell of a lot of problems once this happens? This is not a magic bullet by any stretch of the imagination.

Yeah, it probably will be painful either way we go. And for sure, to get back on track will require patience and pain on ALL our parts, rich and poor alike.

But I liken it to pulling blood sucking ticks off a pet pup. Sure there will be some discomfort for your pet, but if you leave them on, you run the chance of the blood sucking parasites killing the poor little pup.

And when I refer to Wall Street, I am talking about blood sucking parasites, as disgusting as that might sound.

They don’t teach omelette-making anymore.

Let banks fail. Stop pretending that printing/digitally creating liquidity fixes a solvency problem. And the horsefeathers of seigniorage would eventually be recognized as a fraud and the market would return to massively expanding the price of credit default swaps and/or downgrading banks/sovereigns.

Cut the stupidity of trying to paper over debts that are not repayable and let defaults happen.

Money-printing is desirable in order to revive the general economy and remove the stranglehold which the superrich have on wealth. Of course, that only works if the printed money goes to *average people*, not banks.

As you do understand, money-printing cannot cover up the fundamental bankruptcy of the banks. (Actually, it could, but only if the economy were revived first, which requires giving the money to the people, not the banks. Shovelling money at the banks doesn’t work when bank earnings keep dropping because *nobody else has any money to give the banks*.)

these “monetesation” ‘solutions’ are simply the continuation of the ongoing wealth transfer via debt control machine of the Federal Reserve. Discussions as if it is anything other is just distraction.

these “monetesation” ‘solutions’ are simply the continuation of the ongoing wealth transfer via debt control machine of the Federal Reserve. Foreclosure Blues

Bingo!

If liquidity was really the problem then a short term loan of existing money would suffice. Instead, we have a systemic solvency problem caused by the government backed counterfeiting and usury cartel (as usual).

It should be obvious that a money system based on theft (immoral), usury (mathematically unsustainable) AND government privilege (fascist) cannot be a good thing.

Agree.

the only question for the powers that be is how to best manage and maximize the theft…ie without blowing up the machine like in 2008…how to use every distraction and ruse available. The latest ‘difficulty’ is in Europe, as if they are not part of the same machine lol…

for all of you that offer ‘solutions’ and wonder why ‘they’ won’t do common sense problem solving…it is because to them it is not a problem…they want your distress!…and they are very good at producing it…

…for all of you that offer ‘solutions’ and wonder why ‘they’ won’t do common sense problem solving… Foreclosure Blues

“They” might like to think “they” have us in an irresolvable dilemma. But if a solution is widely broadcast then “their” political cover evaporates.

And I often wonder if “they” might not be not “us”.

i apologize for my grammar…but ‘they’ are def not us…

of course we would like to see working solutions…

as old and jaded as i am and i guess i just don’t see ‘them’ ever giving up an inch of what has been a very successful plan for over 100 years…

i just don’t see ‘them’ ever giving up an inch of what has been a very successful plan for over 100 years… Foreclosure Blues

The world is too dangerous for that crap any more. They should be seeking a solution that allows them to quit while they’re ahead and while they have still have heads.

Laugh the global inherited rich out of control of our society and into rooms at the Hague

While you acknowledge involvement of the Fed Reserve in these dealings, you are surely aware that that institution is not a government institution and that the Executive Branch of the government supposedly appoints qualified board members [recommended by the private banks], it is unclear why you identify the ‘government’ as a/the culprit. It seems to me that the members of the private banking system are permitted to exert their best judgements [which strikes me as a reflection of bad judgement on the part of the government]. Could you explain/further clarify?

Mr. Wilson, your naivete is either ingenuous or charming, depending on taste.

To clarify, nonetheless:’the members of the private banking system are permitted to exert their best judgements [which strikes me as a reflection of bad judgement on the part of the government]’ because — to quote Dick Durbin — the banks ‘frankly own the place.’ The place being Washington and most especially including the White House: the current administration serves the financial industry as the previous one served the energy industry.

it is unclear why you identify the ‘government’ as a/the culprit. William Wilson

Government is not the culprit EXCEPT that it enforces a private money monopoly that allows the banks to loot us.

Banks have been in bed with government since at least 1694. It’s time they be thrown out in the cold.

correct the govt is the enforcement agent…

the reason I’m saying what I’m saying is that unless/once we know exactly where the problem is coming from then we can really do something about it

As long as we are driving for clarity, lets take on the “banks” and “banksters” terms.

Banks are owned by the global inherited rich who hire, fire and direct the banksters taking most of the world’s ire. They are the folks behind the curtain who must not be discussed.

Laugh the global inherited rich out of control of our society and into rooms at the Hague.

Bear market? If you blinked, you missed it.

Bear markets traditionally have been defined on a closing basis. Currently that would mean an S&P close below 1090.89. The S&P traded below that level for about 1-1/2 hours this morning. But at mid-session, it’s up a couple of points … while the NDX is up 1% and the RUT is up 2%.

Meanwhile, VXO (‘VIX classic,’ if you will) reached a towering 49 intraday, just short of its excursion above 50 on August 8th.

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=vxo&insttype=&freq=1&show=&time=5

I love fading strident bearishness. Balls to the wall long, baby!

And yet in the end debts that cannot be repaid won’t be.

Beward of dead cats bouncing.

it would seem that there are 2 things that will severely constrain the Fed/ECB

1)commodities and Precious Metals.

The market learned from the post-Lehman drop off. They learned that the Fed will prop up equity valuations by so called “printing” (although obviously it’s not quite the accurate word).

The big winners were those who flocked to oil, commodities and PMs.

there is no doubt that equities are affected by “liquidity” but it seems that commodities are moreso… with devastating effects. therefore it seems to me that efforts to reflate equities will instead flow into commodities again, but this time at a more rapid clip…

2)

how to do this politically given what happened last time. The Fed/ECB can shovel all it wants into the banks, where it promptly dies. going into an unfillable hole, into CEO bonus payments, and into the pool where the bank can leverage/gamble.

none of it is transmitted to Main street, and thus the added liquidity lacks any velocity…

Main street noted that the banks got Golden parachutes while Main Street got a golden shower.

thus: politically it will be trickier. Do they honestly think they can say “what’s good for Wall St is good for Main St” again?

Thus, the Fed/ECB will need to come up with a way of propping up equity and the banks, WITHOUT allowing commodity price appreciation, AND HOPEFULLY transmitting the bank/equity improvement through to the average John and Joe.

it’ll be tough.

I agree, it’ll happen, but we’re going to have to see carnage in the equity markets first to scare Joe-6 into agreeing.

and calls for nationalization will be strong.

‘…the Fed/ECB will need to come up with a way of propping up equity and the banks … transmitting the bank/equity improvement through to the average John and Joe.’

Ding.

Of course, TPTB will first try to transmit any such improvement _through_ the average Jack or Jill in order to feed the banks.

The Emergency Homeowners Loan Program is such an effort, commenced in the US home/foreclosure arena via HUD this past July. Of course, it’s a drop in the bucket, mainly feeds the lenders and servicers, and — most of all — fails to solve the underlying problem, since that would require drastic loan mods and would sink the banks….

http://finance.yahoo.com/loans/article/113040/more-money-for-struggling-homeowners-smartmoney?mod=loans-home

‘For the roughly four million homeowners who have fallen behind on their mortgage payments, the federal government is offering yet another remedy: free money to catch up on their loans.

‘…called the Emergency Homeowners Loan Program, is the latest in the federal government’s efforts to slow down the flood of foreclosures a necessary step to a meaningful recovery in the housing market, says a Department of Housing and Urban Development official. For people who have lost their jobs, the $1 billion program offers loans of up to $50,000 that don’t actually need to be repaid, if applicants meet certain requirements.

‘The loans are interest-free. Payments go directly to the lender for a portion of the borrower’s monthly mortgage, including missed payments or past due charges….’

Etcetera.

you guys really dont get it…they are getting done exactly what they want..continuous extraction…it does slow em down just a little when the truth is exposed…but that is why the need for the giant MSM distraction machine that causes you to think that there is even the slightest concern for your welfare…lol

And I think _you_ are naive to imagine that this is primarily about a ‘distraction machine’ to make us little people imagine that there’s ‘the slightest concern for your welfare’ at this point. I ‘get’ perfectly well that continuous extraction is what ‘they’ want — that these financial entities are in large measure inherently constrained to be ‘crimogenic,’ in Bill Black’s terminology.

I noted, after all, that these loans that’ll ultimately serve the banks’ balance sheets are being fed _through_ the average Jack and Jill, and without substantial mortgage cramdowns many average folks who play this game will end up deeply screwed.

‘Continuous extraction’ _cannot_ continue, all that said, when there’s nothing left to extract. A parasite that kills its host is likely to end up dead, too.

And that’s the real point here: a dawning recognition by elements of the TPTB that the parasite of financialized capitalism has reached a stage where it must make efforts to prop up its host so as to continue to extract. Unlike you, I don’t believe ‘they’ even care what we think at this point. What is focusing ‘their’ minds is that there’s increasingly nowhere for them to run with their wealth with the whole global financial system becoming poisoned.

they care very much what we think…they are obsessed with the distraction…because they know that sudden noncompliance is the endgame for them…

“‘Continuous extraction’ _cannot_ continue, all that said, when there’s nothing left to extract. A parasite that kills its host is likely to end up dead, too.”

that is a really good point…that is why their focus on ‘management’ is so important to them…

goal is to maximize without kill lol…

i have contemplated your point…my observation is that they still believe there is plenty more to get…and i can see that when i drive around the city…

they aren’t finished…that is why u will see QE 3 4 5 and a euro bailout all funded by the Fed…Im laying 20/1 on it…it is so clear when you look at it this way…

they have no intention of any other path…they are doing exactly what it is that they want to accomplish…

Thus, the Fed/ECB will need to come up with a way of propping up equity and the banks, WITHOUT allowing commodity price appreciation, AND HOPEFULLY transmitting the bank/equity improvement through to the average John and Joe.

it’ll be tough. Yearning to Learn

Actually, it would be easy if we:

1) Banned further “credit-creation”, the cause of the problem. Genuine loans of existing money could still be made.

2) Bailed out the entire population, including savers, equally at a rate that just replaced existing credit as it was paid off. The bailout would continue till all private credit debt was paid off.

There it is – a plan that would fix everyone from the bottom up including the banks and with no serious price inflation risk.

So who would it hurt? No one that I can see. The rich would still be rich but their relative wealth would be decreased. That’s a good thing for their own safety.

It’s proven nearly impossible to ban private credit creation (there’s always some way around it), but it *would* be good if the government *discouraged* it — it would keep a handle on the bubbles.

I agree with you that fiat issued by a democratically controlled government is the only legitimate money to declare “legal tender”. Unfortunately, we don’t even seem to have democratically controlled governments. If we did, we could also have a “post office bank” type operation for conservative savers.

The private banking cartel has completely screwed up and proven dramatically that they should not be allowed to run the economy…. but they’re still in charge.

On your second point, transfer of wealth from the obscenely rich to the rest of the population — which can be done by simply printing money and handing it to the rest of the population, or by taxing the obscenely rich — is of course *essential* to a stable society.

At least so long as we have processes which make some people get obscenely rich, and it’s proven hard to get rid of those (even the Communists didn’t get rid of those processes).

Wouldn’t a lot of small businesses, among other entities, have a need to borrow during this time of paying off debt? Isn’t there a legitimate need in the economy for a certain amount of borrowing? How would that be allowed to occur?

Off topic: Just saw the headline in today’s paper that Carlyle Group has paid $3.9 Billion for PPD a local based contract drug research company. PPD is the areas third largest employer and I have a bad feeling about this. Private equity firms appear to be extractive in dealing with takeover targets – asset stripping firms for quick gain.

Any thoughts?

Jim

PPD’s future in Wilmington uncertain after sale http://www.starnewsonline.com/article/20111003/ARTICLES/111009950/0/FRONTPAGE

Personally I’m hoping they stay in town, as we have some rental property there. Here’s the business view on the sale…

$3.9-billion deal for PPD a wise move, analysts say http://www.starnewsonline.com/article/20111003/ARTICLES/111009958/0/FRONTPAGE

By becoming a private company, PPD will face significantly less regulatory scrutiny, said University of North Carolina Wilmington professor Ed Graham. The company will no longer be required to report its quarterly financial performance and already announced Monday that it does not plan to release its third-quarter results from this year.

One year ago, the Carlyle Group bought Caritas Christi Health Care, a Catholic Hospital chain in MA and are transfomring it inot a for-profit hospital organization. http://articles.boston.com/2010-10-30/business/29303631_1_hospital-group-catholic-hospitals-community-hospitals

Ooop, it was Cerberus that bought out Caritas. Given how incestuous those two firms are, I keep forgetting that they are “different.” The evidence at Google search seems to show they are affiliated, however after following the Wikipedia link the articles no longer show that. Does anyone know if the Carlyle Group owns Cerberus, or are they just very good friends?

Europe has not one but a series of crises: the euro, the lack of a fiscal/debt union, austerism, an ineffectual ECB, unsustainable trade patterns/German mercantilism, and of course kleptocratic elites. What we see is that only one of these, the euro, is being addressed at all, and that completely ineffectively.

What this should tell us is that no solution is on the table or even on the horizon. So while there might be a few respites based on even more flimflam, we should expect the European crises to only worsen.

One further note. 11,000 on the Dow was a previous resistance level. There is no real reason to accord this number any special significance, other than a psychological one but when you have bubble markets untethered from reality that’s really all you have. I suppose this bear market borderline is another. There are two conflicting forces at work here: the bubble blowers bidding up prices and those looking at the Euro mess and BAC who are heading for the exits. It is the old dichotomy of fear and greed. Which will win? For us rubes, it scarcely matters.

The U.S. should have nationalized the zombie banks back in 2008 and followed the same basic course as they did during the S&L scandal. They should not have listened to Paulson who was running around with his hair on fire.

The mantra of the Obama admin thus far has been “anything to save the banks” = “saving the economy”, when it should have been “what is good for the people” = “saving the economy”.

Seems to me extraordinary measures have been taken to avoid the big guys taking any “haircuts” at all, while the result has been to pluck the people’s hair totally bald.

Let’s be frank here.

Many people have been bald for a while.

Just want to say: This thread contained some amazing observations and wisdoms. Especially thankful to those who are speaking up and naming “the man behind the curtain,” and to Yves for offering a space and place to do so.

The Europeans need to pick one, full monetisation or default and recap, and see it through.

This is likely a dumb question, but doesn’t either of these scenarios translate into German bonds being insanely overvalued at current yields? In one case, you have a currency risk, and in another you have a credit risk, I think (?!?)

http://www.bloomberg.com/markets/rates-bonds/government-bonds/germany/

Mon dieu! Life as a derivative of ever increasing, shorter duration, credit events…computational trading…orders of magnitude in speed and in eitheresq trades…electrons have no fear…silly monkeys.

Skippy…CDS vs. LHC

I know its a crazy train, but, could we have the smooth jazz version please?

http://www.youtube.com/watch?v=OMxAq0Ofupw

alternatively, we could get back in the black (funky version)

http://www.youtube.com/watch?v=OMxAq0Ofupw

Skippy…gotta dance now!

Is there something missing from my browser? On my RSS feed I see a post entitled “Swat Team in St. Louis Barring Customers From Withdrawing Funds from BofA” and yet on the Naked Capitolism home page I see no such post. Were you pranked? Did you pull the post for some reason?

I watched the Youtube clip and tried to post a comment. I think she pulled it…

Yes, I found the clip and watched it as well. Interesting. Can’t judge if it was staged or not, tho. The cops are obviously real and the story feels true. I can see where BofA would have a problem with a mass protest withdrawal but the bad publicity online would seem to be a countervailing arguement. I dunno.

The funny part is the guy being told that he should withdraw his money by going online, given what their online access is like:

http://bucks.blogs.nytimes.com/2011/10/04/bank-of-america-web-site-still-troubled/?scp=3&sq=bank%20of%20america&st=cse

Incidentally, if this is *not* the result of hacking, but just heavy traffic, isn’t that a pretty good indication of a run on the bank? Or am I missing something?

I actually sympathize a bit with BAC–JPM, WFC, GS, and MS aren’t really much better, yet everybody’s ire is drawn to this one bank–the only one that actually replaced its CEO since 2008…

BTW, since it’s the customers’ money and they have a legal right to it I don’t understand why it matters what reason is given for withdrawal.

The irony is that all banks are probably going to do this sooner or later–the yield curve isn’t giving them much to work with right now…

True.

The video came from this site and was up already on Aug 24th:

http://www.youtube.com/user/PeopleJustLikeUs#p/search/2/CMgyfuXJHes

The problems could all be solved by monetizing the government debt and printing money, inducing some inflation…. IF IF IF the newly printed money was handed to the poor and middle class, rather than to rich private bankers.

*Nothing* can be solved as long as the money keeps going only to the elite bankers. That will keep choking the economy. Unfortunately, our elites appear to be owned by bankers and unwilling to let them go bankrupt.

The problems could all be solved by monetizing the government debt and printing money, inducing some inflation

Ummm…printing $14trillion will induce a hell of a lot more than “some” inflation.

Ummm…printing $14trillion will induce a hell of a lot more than “some” inflation. TM

That depends. If further credit creation was forbidden then the bailout checks could be metered to just replace existing credit as it was paid off. Since the total money supply (base money + credit) would not change then no significant price inflation should be expected.

LOL–there’s no need to prohibit credit–it’s going to be priced out of most people’s ability to borrow soon, anyway.

Actually, it likely wouldn’t induce any inflation — but don’t ask me about it, ask a liquidity-trap expert like Krugman. :-) Even if it did create some, it wouldn’t be important — the rise in prices would be a lot less than the rise in wealth which the average people receiving the printed money would get, and it would generally create prosperity.

However, as usual, this would only be the case if the printed money went into the hands of the *right people*. Namely, the poor and middle classes.

Distribution of wealth — who has the money — is the key issue right now, not the price level. Printing money and handing it to the BANKS or the SUPER-RICH is a disaster. (Not an inflationary disaster, but another speculative-bubble disaster.)

To be clear, I think the chances of our corrupt, both-parties-owned-by-the-bankers government, or any of the similarly-owned major European governments, or the Japanese government, actually giving printed money to the *people* rather than to the powerful — I think the chances of that are pretty much zero.

I’m just saying what would work if we had a legitimate government which cared about people’s welfare. It has no chance of being implemented, because priority one of our governments has been to protect the private banks, while priority two is to protect the superrich.

Agree but note my comment above. The entire population could be bailed out with no significant price inflation risk till ALL private credit debt was paid off IF further credit creation was forbidden during the bailout period.

Distribution of wealth — who has the money — is the key issue right now, not the price level

This is sort of circular. Rising prices would negate any of the wealth redistribution. It would also leave the lenders (big and small) broke, which would eliminate capital required to build anything.

I’m not sure why you’d go through all the trouble when you could just let everybody who wishes to claim bankruptcy do so (which is legal) and, if you like, redistribute wealth or income via the tax code.

Rising prices would negate any of the wealth redistribution. TM

Not so if the distribution was done as I’ve indicated.

Please explain how prices could rise with a constant money supply?

1. velocity would go up

2. (linked to 1) Available currency will increase wrt other currencies

3. production would go down

4. Those spending the money will be concentrated on what they spend it on

I’m sure there are lots of other reasons, but that’s what immediately comes to mind. By itself, it’s scary enough.

It’s good to see you know P = MV/Q.

However, velocity is almost always constant except for periods of hyperinflation. As for declining output,Q,are you assuming that people would quit their jobs just because they got bailout checks from the government?

By itself, it’s scary enough. TM

Scared of justice, are we?

You should be scared by lack of justice.

@Beard.

You do understand exponentialism right, the numbers you suggest increased complexity = increased unknowns = likelihood of swans of unknown colour.

Skippy…6 nuclear reactors lined up like ducks in a row seemed on paper like a good ideal…eh. Yep justice is coming, not ours, but, the Universes.

PS. mitigation is my last hope.

Yep justice is coming, not ours, but, the Universes. skippy

Your belief system (or lack of one) may paralyse you but mine commands me to “Do justice” (Micah 6:8).

@beard.

The word “belief” is a difficult thing for me. I don’t believe. I must have a reason for a certain hypothesis. Either I know a thing, and then I know it – I don’t need to believe it. – Carl Jung

—-

Skippy…Paralyzed (throw away phrase), hardly, I’m extremely occupied at the moment.

The word “belief” is a difficult thing for me. I don’t believe. I must have a reason for a certain hypothesis. – Carl Jung skippy

I have plenty of reasons to believe what I believe.

hardly, I’m extremely occupied at the moment. skippy

Well, good for you (I assume you mean busy helping others).

It’s good to see you know P = MV/Q

I thought that was one of the basic economic equations and assume that everybody knows it(???)

velocity is almost always constant except for periods of hyperinflation. As for declining output,Q,are you assuming that people would quit their jobs just because they got bailout checks from the government?

Umm..I think dropping $14tr would create the “hyperinflation” you mention.

As for declining output,Q,are you assuming that people would quit their jobs just because they got bailout checks from the government?

No, I’m assuming that people without capital will not create production.

Scared of justice, are we?

What’s the justice in this? You are essentially wiping out everybody’s savings, and you’re doing it in the most destructive way imaginable. Again, if you insist on wealth distribution, do it through the tax code.

Umm..I think dropping $14tr would create the “hyperinflation” you mention. TM

The bailout checks would be metered out to just replace existing existing credit as it was paid off. With no new credit to replace it then the money supply would remain constant. Hence no hyper-inflation.

No, I’m assuming that people without capital will not create production. TM

Legitimate lending would still be permitted. And with the bailout metered as I’ve described there would be plenty of new savings to lend out. But if you insist then the amount of the bailout checks could be increased to provide the needed “capital” until price inflation became significant.

You are essentially wiping out everybody’s savings, TM

Wrong. Savers would receive an equal amount too and in money with the same purchasing power.

and you’re doing it in the most destructive way imaginable. TM

The only thing I see destroyed is illegitimate debt, illegitimate wealth disparity and a government backed and enforced counterfeiting cartel.

Again, if you insist on wealth distribution, do it through the tax code. TM

Wrong. Taxes should not be raised in a recession. What the economy needs is plenty of new money in the right hands, those of the victims of the counterfeiting cartel, the entire population, both borrowers and savers.

My understanding of the current situation is that V has, in fact, crashed. I’m not sure where to find a current ‘V’ measure, but indirectly, the M1 Money Multiplier is even lower than it was the middle of the (technical) recession. If this is the case, then we certainly cannot treat ‘V’ as a constant. I think this is part and parcel of the liquidity trap issues.

From the federal reserve:

http://research.stlouisfed.org/fred2/series/MULT

This is why the QEs haven’t truly fixed things. It’s the pushing on the string problem. The fed can create money and hand it out to the banks, but they are not able to control the final destination of the printed dollars. So we get the commodity bubbles like in gold and oil, bank money chasing the next big thing. Mom and Pop’s local store isn’t getting more customers because a great number of people are pinching their pennies. So businesses aren’t hiring, or purchasing new assets, or expanding.

Found it (also St. Louis Fed):

Velocity of M1 Money Stock:

http://research.stlouisfed.org/fred2/series/M1V

and M2:

http://research.stlouisfed.org/fred2/series/M2V

If this is the case, then we certainly cannot treat ‘V’ as a constant. Maria

Thanks. I should have said “nearly constant”. But you make the case that we need an increase in velocity and I agree so that it reaches more nearly normal levels. (Not that I am in favor of wild consumer spending).

That is what I believe. And I think it is part of the impetus among traditional Krugman style Keynesians to argue for jobs program or more stimulus at the federal level. Even if people are not convinced of the value of the asset — suppose we built a Japan-style bullet train from NYC-Chicago-SLC-LA from scratch, rails and all — it would employ people at every stage of the pipeline, especially if was required that everything be ‘made in USA’. (I’d be keen on a bullet train — but that’s me.)

People who have secure jobs will buy new clothes for their kids, new cars, tvs, computers, washing machines. People who are unemployed or underemployed, or are afraid of losing a job, buy used (think Goodwill, Saturday garage sales, food banks) rather than buying new goods. There’s nothing wrong with used goods — but used goods don’t employ current workers and probably slow down the overall monetary velocity.

Markets are driven by fear right now. Gold should be going up, but it isn’t. Hard to tell what’s really going on.

The end-game for the wealthy and gov’t in my opinion is simply a currency re-set – such as in a new one or in digital currency. Then you DO have full control. I would love anyone with expertise to comment on this. Unfortunately, I have no such expertise.