Richard Koo of Nomura published an important piece earlier this week which got some attention in the financial blogosphere (Clusterstock, FT Alphaville). It takes issue with a critical part of the economist optimists’ case, namely, that consumer deleveraging is about done and therefore the economy is likely to perform much better in the next few years.

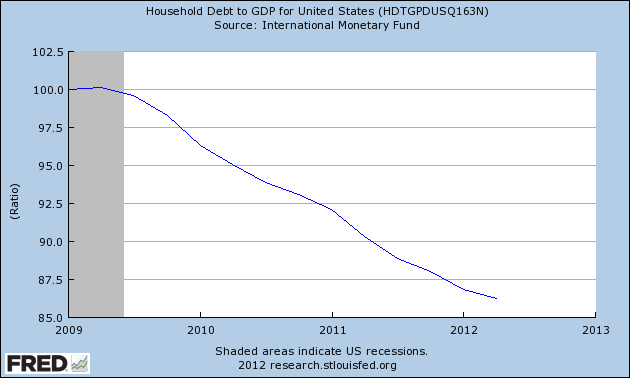

I have doubts even with the thesis as stated, given that the assumption is that having consumers releverage would be a good thing. We have stagnant wages and short job tenures and concerns that demographics will no longer drive growth in the US, combined with the fact that the BIS has found that household debt to GDP ratio of over 85% are associated with a negative impact on economic growth, and we are still above that level:

And that’s before you get into the issue of the composition of debt: a lot of the deleveraging has been involuntary (foreclosures and bankruptcies) and has been partially offset by rising levels of student, which is more pernicious than credit card or mortgage debt, since it can’t be discharged in bankruptcy, and is accumulated at the beginning of an adult’s income-earning years.

Koo makes a different point: that some of the figures that the bulls have cited as positive are anything but:

Those making this argument [that deleveraging is over] seem to be basing their views on the fact that the Fed’s Flow of Funds Accounts show the US household sector as a net investor in 2012 Q3, the first time that has happened since 2007 Q2…the US household sector was characterized by a financial deficit of 2.8% of GDP, and this, I suspect,

led some to argue that the US balance sheet recession was over.

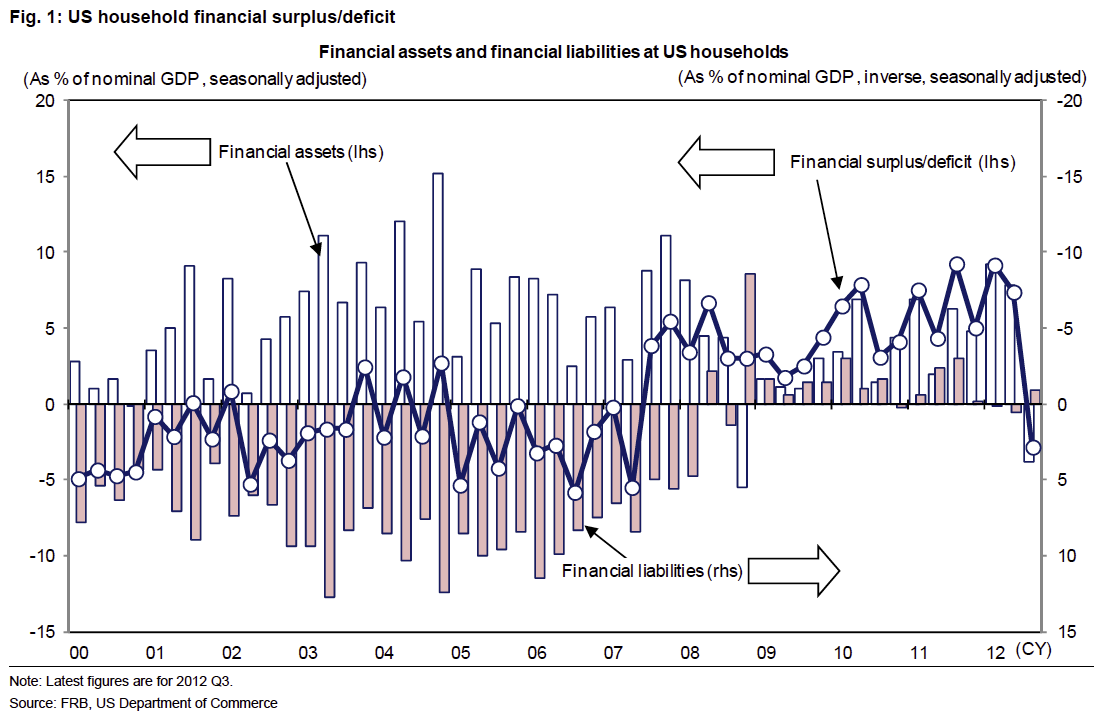

Koo refers to this chart to make his point (click to enlarge):

The white bars are financial assets and the red bars are liabilities. The blue line is the difference between the two. Koo again:

While US households did indeed run a financial deficit in Q3, the deficit was not necessarily driven by positive factors. If people who had been paying down debt to repair their balance sheets had actually resumed borrowing, it would mean that balance sheet problems were behind us. However, the fact that the latest colored bar in Figure 1 is above zero indicates that US households are still paying down debt.

Inasmuch as this act of reducing financial liabilities in spite of zero interest rates runs counter to the principle of maximizing profits, it suggests that US households continue to undertake balance sheet adjustments.

And the implications…

The answer can also be found in Figure 1:the fact that the latest white bar is below zero means households drew down financial assets in the quarter. And that is hardly a good sign. It has happened only three times since 2000, including the present occasion.

The first instance (barely visible in the graph) was in 2000 Q4, when the Internet bubble collapsed. The second was in 2008 Q4, when the failure of Lehman Brothers sparked a global financial crisis. People faced cash flow problems in both periods andprobably were forced to draw down existing savings to make necessary payments.

During the bubble period towards the middle of Figure 1, much attention was paid to the fact that the US household savings rate had turned negative. While the sector did run a financial deficit during this period, the deficit was attributable to the fact that the increase in financial liabilities (ie growth in borrowing) was greater than the increase in financial assets (ie growth in savings). There was no drawdown of financial assets.

Hence we need to pay attention to the fact that the latest figure shows only the third drawdown of financial assets since 2000 and that this drawdown is responsible for the financial deficit in the broader household sector. The reason: if household consumption is being financed by the drawdown of financial assets, it is not likely to be sustainable.

This pattern of drawing down financial assets while reducing financial liabilities has been frequently observed in Greece during the last two years and is definitely not a positive development, in my view.

I know the plural of anecdote is not data, but I’m not hearing a lot of optimism in the cohorts I’m in contact with. Most people are less freaked out than they were in 2009 and 2010 but while you can say that trend-wise, it’s an improvement in confidence, that does not translate into confidence in the animal spirits sense. One telling story: a former client who was a partner in a financial firm that was sold at a very handsome price and has a net worth somewhere north of $15 million (how much I have no idea) was visiting New York. He and his wife live part of the year in Chicago and are renovating their apartment. She remarked that she had just been in the D&D Building because the showrooms for the Chicago decorators had become very spare since the downturn. I said I was surprised, prices at art auctions were hitting new highs. She said that the people at the top might be spending, but it was different at the next layer. For instance, when she called the contractor she had used before to ask about his schedule for the spring, he signaled he was wide open. Later he said that his 4th quarter had been “OK” and if the rest of the year had been as weak as his first quarter 2012 had suggested, he wouldn’t be in business.

Koo also pointed out that the business sector is still net saving. As we’ve written before, when the household sector and the business sector are both saving, the government sector needs to run a deficit or the economy contracts (unless you can run a trade surplus, which is not the situation the US is in):

The US corporate sector, which is said to be healthier than the household sector, remains a net saver in spite of zero interest rates—in other words, savings are still increasing.

It is often argued that US companies are healthier financially than US households. However, the white bars in Figure 2 show that businesses were forced to draw down financial assets for five straight quarters from 2008 Q1 through 2009 Q1.

This is the period that started with the challenge of Bear Stearns, triggering extreme dysfunction in the US financial system. As a result many companies found it extremely difficult to obtain funding. This should also be clear from the fact that funds raised by US corporations (ie increase in financial liabilities) declined sharply from 2008 Q1 onwards.

For four quarters starting in 2009 Q1, US businesses paid down debt at a time of zero interest rates—in other words, growth in financial liabilities turned negative. US households and businesses alike were desperately deleveraging in an attempt to repair their balance sheets.

The debt repayment subsequently stopped and companies began borrowing again, but that was more than offset by an

increase in financial assets. The financial surplus condition at US companies has continued to the present in spite of zero interest rates.In that sense, I think we can say that balance sheet adjustments continue in the corporate sector, although perhaps not to the extent of the household sector….

Even in the aftermath of the Internet bubble collapse, during which the necessary adjustments were far milder, it took 12

quarters—three full years—for corporate sector behavior to return to pre-bubble norms.Given that the shock of the housing bubble collapse was several times greater, I suspect that at least several more years will be needed before US companies stop increasing savings and resume borrowing money to expand operations.

Even with this, Koo is overstating the degree of the return to normalcy. We noted that corporations were net savers in a November 2005 article:

Companies typically invest in times like these, when profits are high and interest rates low. Yet a recent JP Morgan report notes that, since 2002, American companies have incurred an average net financial surplus of 1.7 percent of GDP, which contrasts with an average deficit of 1.2 percent of GDP for the preceding forty years. While firms in aggregate have occasionally run a surplus, “. . . the recent level of saving by corporates is unprecedented. . . . It is important to stress that the present situation is in some sense unnatural. A more normal situation would be for the global corporate sector—in both the G6 and emerging economies—to be borrowing, and for households in the G6 economies to be saving more, ahead of the deterio- ration in demographics.”

Obsession with quarterly profits has produced an unhealthy tendency towards underinvestment even in economic expansions, since capital investments also entail expenses (marketing, hiring staff, etc) before the new project is productive. It’s thus hard to see how anyone (except stock brokers) is buying the CBO line that cutting the deficit when unemployment is still high and companies are tightfisted will only produce a two quarter downturn before the confidence fairy emerges and growth resumes. That sort of forecast looks an awful lot like the classic hockey stick in presentations to venture capitalists: invest in us, we’ll have a short period when we’ll lose money as we are ramping up, but then we’ll show juicy growth and profits. VCs know to be plenty skeptical. It’s too bad that the media and policy makers aren’t.

Can someone explain why one should focus on debt to GDP and disposable income?

I understand why debt to GDP is a good metric for assessing sovereign leverage, but why for households? How about looking at household’s ability to pay bills and debt service, similar to corporate metric of cash flow available for debt service? That will be influenced by cost of living (food, rent, healthcare, education, insurance, and taxes) and debt service (mortgage and other personal debt service costs; principal plus interest).

Perhaps this was covered in the article, but when I saw GDP in the first two charts, I didn’t bother to read any further.

Fundamentally a nations economic engine goes wages > consumption > production > wages.

Private debt servicing happens between wages and consumption (or between consumption and production in the case of companies), leaving less to rotate thru the next cycle. In essence it acts as a break.

This even tho the initial loan may act as a nitrous injection by increasing the amount of consumption and so spur more production and wages. But too much of that and you blow up the engine.

In essence, a short term gain but a long term pain if overused…

Not all newly created debt gets funneled into consumption and production. When too much of it gets funneled into buying legacy (existing producing) assets, past production (existing houses, for instance) or speculation, one ends up merely blowing asset bubbles with all the new debt, what Minsky called a Ponzi economy.

And this is exactly what the United States has done for the past 30 years.

From Mexico:

Well said!!!!

both durable goods (housing, cars, boats, and such) and paper assets fits inside consumption and production if one take a wider view on both.

Yes, and after Minsky called what we have today ponzi finance, he studied for many years on how to correc this instability which has resulted.

In the end he called for a new monetary structure, one where the private banks maintain the functions of credit and finance and where government becomes responsible for the money creation part.

Financial Instability and the Decline (?) of Banking:

Public Policy Implications

http://www.levyinstitute.org/pubs/wp127.pdf

He thought Fisher’s 100 Percent Money proposal should be on the table. And to get it there, Minsky called for a new national monetary commission so that we could achieve a proper progressive democracy.

How many solutions are on the table now?

Joe,

this is very interesting. It looks like Minsky took 100% money more seriously than his followers seem to now. Have you seen the “Beyond the Minsky Moment” publication (also downloadable at the Levy site)? On pp.57-58 they discuss the “Fisher-Simons” proposal. Basically they don’t prefer it because it fails in their view to meet Minsky’s requirement to “capitalize an advanced capitalist economy.” They do admit that it might work given an adequate amount of fiscal injection. Same thing MMT with MMT, right? At least two of the big MMT names are listed among the co-authors.

Excellent! That is the most concise and comprehensive description of a national economy I’ve ever seen. Income leads to spending leads to production leads to income. Brilliant!

@ mafer

Aren’t you being a bit pedantic? And I’m not at all clear the point you’re trying to make.

Perhaps one could get a more accurate picture if they focused on the ratio of household debt and household debt service to aggregate household gross income.

However, that’s probably going to paint an even more dismal picture than the one painted by Koo. In 1982, business net income and net capital gains as a share of aggregate national income amounted to only 4.5%. By 2005 they had grown to 18% of aggregate national income. Almost all this extra income flowing to business came at the expense of salaries and wages.

http://www.taxpolicycenter.org/legislation/upload/x-1-11.pdf

I don’t have any references at my fingertips, but I think this trend has only accelerated since 2005.

This situation is worse if we look at aggregate household net income. This is so because of the fact that more and more of the federal tax burden has been shifted off of business and onto salaries and wages. In 1982, employment taxes accounted for 32.6% of total federal government revenues. By 2009, they accounted for 42.3%. Even though corporate profits have increased many fold in the 1982 to 2009 period, the share of federal taxes they pay has remained constant at around 10%. In 2009, the percentage reached a new low of 6.6%. Corporate taxes have soared, but their taxes have remained fixed at 1982 levels when they were making much less money.

If we look at the income situation of the median household, the situation becomes even more bleak:

“Real Median Household Income in the 21st Century”

http://www.ritholtz.com/blog/2012/11/real-median-household-income-in-the-21st-century/

This is so because almost all the household income gains in the past 30 years have accrued to the top 20% of households, and almost all of that to the top 5%:

Table H-2. Share of Aggregate Income Received by Each Fifth and Top 5 Percent of Households — All Races

http://www.census.gov/hhes/www/income/data/historical/household/

If we look at household net worth, that paints an equally bleak picture. The hardest hit age group was the 35- to 44-year-old group, whose median net worth decreased by 59 percent between 2005 and 2010. For all households, median household net worth decreased by 35 percent. The group that fared the best was the 65+ group, who saw its median net worth decline by only 13%. I would think that’s so because older households have a lot less leverage (debt) than younger households.

“Changes in Household Net Worth from 2005 to 2010”

http://blogs.census.gov/2012/06/18/changes-in-household-net-worth-from-2005-to-2010/

I was reading something the other day that said for that 65+ component, the equity in the home they lived in constituted more than 80% of their assets.

“I don’t have any references at my fingertips, but I think this trend has only accelerated since 2005.”-fM

Here’s a chart I made that gets at that a little.

The blue line is total “Personal Income,” the red line is Employee Compensation (wages and salaries), measured on the left scale. The orange and green lines show, respectively, the share of income received by employees as a percentage of the total, and the share not received by employees (which I imagine is a pretty good proxy for 1%-er income).

The trends are all very clear, and just what you’d expect.

Here’s a link to the graph showing the ratio of household debt to personal income. Looks similar

https://research.stlouisfed.org/fred2/graph/?graph_id=104584&category_id=2981

The notion that GDP numbers have anything but a spurious relationship to the well being of the under classes known as the 99% is something that only an economist could believe.

Drop bombs costing a half trillion dollars on the latest target in the Middle East? No problem, after all it adds to the GDP.

Add a few more percentage points to the 40% of “economic activity” represented by the financial sector? All good– another boost to the GDP.

Ratchet up the building boom of 10,000 sq. ft. log palaces in Jackson Hole? Employs ski bum carpenters so they can buy beer, burns up heating oil, and increases the GDP.

Hire more paper shufflers to administer Obamacare’s insurance price fixing scheme and increase the 45% of medical costs that go to bureaucracy in the US medical system? Another giant step forward for GDP.

Make sure the Northern Alliance in Afghanistan has continued military protection while producing opium for the heroin trade? Keeps the profits recycling back into the US economy through the laundering facilities in the banking system and increases GDP.

If you want a relevant metric you should use the cost of cat food instead of Gross Domestic Production.

I often hear that Corportions are flush with cash, but much of that is because they have borrowed. Borrowed funds must be paid back If there’s a positive here, its’ that corporations have a cushion in the short to medium term if the economy tanks, but the claim that corporations are long cash is not right if it excludes the borrowing.

Secondly the major sector where consumer borrowings have occured are Student Loans and sub-prime autos. The former will prevent consumption and delay housing formtion. Too often student loan debt turns into shackles that cannot be undone. The latter sub-prime auto debt sounds too much like the mortgage equivalent and I think trouble lies ahead.

Thirdly home owners have not been paying down debt as much as defaulting on it or getting mortgage forebearance and forgiveness. Borrowers doing a “cash-in” finance has not been that strong, although it does occur when ltv prevents a refi.

While the ability of the American Consumer/Borrower to lever up an not save has never cease to amaze me or the willingness of banks an sub-prime finance companies to lend to these same borrowers, I just don’t see the wiggle room for over-leverage borrowers to borrow more.

Yardeni Research took Fed data and used it to create an outstanding series of graphs:

http://www.yardeni.com/pub/fofchrt.pdf

It pretty much confirms what you are saying. If one looks at Fig. 6, one can see that business debt as a percentage of GDP has fallen only slightly since the onset of the GFC, and remains at near historic highs. It’s currently almost 80%, as compared to 47% in 1982.

If one scrolls down to Fig. 16, however, one can see that businesses have began to borrow again. Households, however, are still deleveraging.

One must also take a look at what corporations are using their borrowings for. The way I interpret Fig. 27 is that almost all new corporate borrowing is being done for the sake of buying back their stock. This is a phenomenon that began in serious in 2004.

The perception that corporations are “cash rich” is probably due to the phenomenon illustrated in Fig. 35. Total corporate liquid assets are now about $1.8 trillion, an historical high and up from $0.8 trillion in 2000.

Fig. 39 shows that households are still very much still delevering when it comes to mortgage borrowing. Fig. 42, however, shows that consumer borrowing is very much on the mend.

Then there are a whole series of graphs that deal with household assets and real estate debt, which to me don’t mean much because they speak of aggregates and not medians. If one wants to know what’s going on with US households, one has to eliminate the top 1%, because such a disproportionate amount of aggregate net worth is held by the top 1%.

Deleveraging?

I guess we want the cake and eat it too. ‘Consumer credit’ may be down, but look at government spending and student loans and the deleveraging thingy is nothing but a hoax.

Releveraging has not even started.

So the pension plans have been sucking up capital and are looking for all kinds of alternative investments to boost returns but the reality is that liabilities will most probably be growing faster than the plan assets over the next 5 years.

And this will only get worse as a large percentage of employees go from 50 to 57, especially if rates don’t rise.

So even if people are saving, it’s not enough to fund their future considering today’s lifestyle expectations.

There are more shocks to coming our way. We are in the calm before the storm.

You can’t print trillions in a matter of a few quarters and expect blue skies ahead. If you think corruption has been bad for the last few decades, imagine during the latest printing fest.

Actually, you *can* print trillions during a few quarters and expect good times ahead…

…what you can’t do is *give trillions to fraudsters and crooks* for a few quarters and expect good times ahead.

To get good times, you would have to give the trillions to honest people who will do useful things with them. If the government had printed trillions and spent it on (for instance) insulating every building in the country, retrofitting them with electrically-powered heat pumps, putting solar panels on every south-facing roof, building giant solar farms, etc., we could have good times.

Instead it went to criminal bankers who spend their time defrauding people. Not good.

Hint: clean up the problem with class-control of the monetary and fiscal system, before issuing more trillions.

The politics must trump.

Sorry but I do not believe we can print trillions in a few quarters without fraud and corruption.

Especially when those trillions were to replace trillions that were generated over many years with the help of corruption!

Make a mess and clean it up. Which one takes longer?

The mess was years in the making… you really think the cleanup can occur over a few quarters?

Overconfidence, a payroll tax hike and soon-to-be-realized spending cuts; it’s looking like 1937 all over again.

I hope I’m being overly pessimistic.

There is a good point about the year 1937…..

It was believed by that year that the Great Depression wasn’t that bad after all and “recovery” was well under way…..and the politicos started to cut way back on “supports” for the common folk and what happened is history…..

We plunged right back in to the mire.

We will make the same mistakes.

That is also history.

I remember the years well……..

Me too … from my past life.

The discount rate doubled in 1937, along with a hike in bank reserve requirements, to put the brakes on rocketing commodity prices.

Compare to 2004-2008: the Bernank more than quintupled the Fed funds rate (from 1.00% to 5.25%), as crude oil also quintupled from its level just before the Iraq war.

Where we are now perhaps more resembles the late thirties, with T-bill rates at zero … and our benevolent leaders spoiling for a nice little hot war to stimulate domestic demand and soak up idle labor.

See you in Tehran, comrade!

The payroll tax “hike” is just a payroll tax restoration to prior levels. The point of the payroll tax was to prefund our own future Social Security benefits payback/payouts. The reason Obama sought the payroll tax “holiday” was to make it permanent so as to help de-fund Social Security in preparation to destroying it. That is why the Catfood Democrats all joined the Republicans in supporting it. The plan was to “permanently holiday” the employER part along with the employEE part so as to defund and destabilize Social Security even faster-deeper.

I do not resent the restoration of the full payroll tax upon myself or anyone else. What I resent is the Catfood Obamacrat Conspiracy to destroy Social Security regardless, to make sure that I “get back” precisely ZEro of the payroll taxes I (through myself and through my employER) have been PREpaying DOUBle EVer SINCE 1983. That is what I resent, and that is what I want to get revenge for, if I can’t prevent. ( And I can only do so much prevention all by myself. It would take a hundred million future SS beneficiaries to figure out how to torture and terrorise the so-called “Democrats” into abandoning and then obstructing the BS Obama Catfood Plan).

I resent the payroll tax because it is monstrously regressive and the only tax that doesn’t have tax-dodges going for it. It really is a testament to how anti-tax the .01% are that SS tax wasn’t reformed (1) to cover ANY income (earned, capital gains, carried interest, dividends) and (2) to cover all income, period.

Ever since our FICA dollars have been used to fund any and all gov programs, the rationale that it should fall regressively on those who are poorer no longer holds.

I could resent the payroll tax for that reason. That is what the anti-SocialSecurity underminers would like me to do. What I resent instead is the recent reduction in upper class tax rates and the Corporate tax rates and the various privileged Capital tax rates which used to be progressively high. Once they were lowered to a fraction of their former level then the payroll tax came to be default-regressive by comparison. So I resent the excessive lowering of upper class taxes.

I also resent the misappropriation of funds and Grand Theft Embezzlement represented by misusing SS prepayment funds to fund the rest of government with the full intention to never ever redeem those special SS bonds. The answer to the Straight Up Two Step Con conspiracy would be to raise all taxes back to Clinton era levels and further raise taxes against the upper class enough to claw back the entirety of their ill-gotten BushCoBama Tax Cuts. And apply it to Federal Debt Instrument Paydown and forcible accelerated paydown of Federal Debt Instrument Principal down to zero . . . and then let the lucky upper class holders of all that money find somewhere else to “invest” it. The other cure would be to say . . . adding the employEE and employER payroll taxes together with income taxes on everyone who pays those taxes; what percent of income is paid into that tax? And how does income above the

topside FICA tax cap cuttoff get taxed by percentage compared to income below that FICA cap cutoff? If the percentage of income tax on income above the FICA cap cutoff is less than the percentage of income and FICA tax together on income at or below that cutoff, then raise income tax on income above that FICA tax cutoff enough to where that percent income tax on over-FICA income comes to the same net percent as income AND FICA tax together comes to in percentage terms on income below the FICA cuttoff.

That would be targetting fixes against the real causes of the resentment, in my mind.

The idea that Payroll tax is NEEDED so the Govt can make Soc Security payments is a gross misunderstanding about our monetary system, perpetuated by Congress.

Back in 2000, I thought there was a big point made by Al Gore regarding keeping Soc Sec in a “lockbox”. In fact, US Securities are added to a “fund”, an account designated for Soc Sec etc on the Fed’s computers.

That means, in normal standard application, Govt “borrows” that money from Soc Security … which makes FICA like a general tax.

In reality, the only dispute is whether the revenue from FICA is subtracted from Govt spending to lower the final figure called “Deficits” — accounting gimmickry for PR purposes to appease conservative minds —- thereby allowing less revenue from OTHER taxes (on the Super Rich), to arrive at the same “Deficit Spending” figure.

Once it is understood that “Deficit Spending” (Deficit Taxing??) is nothing more than Govt ADDING net financial assets to the real economy by increasing people’s bank balances —– at a much slower and more measured pace than what out-of-control banks do when they smell the blood of profits created by a asset bubbles based on fictional price increases —- and we realize we WANT to continually increase NFAs, not cause our savings to shrink and be destroyed —- then the whole context of Deficit Spending worries and Pre-Funding retirement and “Saving” funds from Payroll taxes, ALL becomes meaningless.

Soc Security payments SUPPORTS sales, profits, business, and wages for everyone. Soc Security taxes REDUCES sales, profits, business, and wages for everyone, being a factor in unemployment and business failures, a drop in prosperity.

It could be seen as a problem that people are so poor that they QUALIFY for Food Stamp Cards, but Food Stamp issuance IMPROVES the economy, particularly during the extreme post-Bubble CONTRACTION of the money supply/supply of credit.

See NEXT

======

Unfunded Liabilities is the same as Funded Liabilities, read article, unless one believes that a Govt that freely issues its own non-convertible non-fixed sovereign currency must somehow stockpile it’s own financial assets in a sealed vault.

The attack on Social Security for the elderly is like Malthusianism, the wretched and anti-human ideology that was utterly discredited in the 19th century. Some miserable modern conservatives are convinced that welfare for the elderly will bankrupt future governments. Like them, Malthus was convinced that charity for the poor would bankrupt his nation. Malthus was completely wrong because he simply did not understand the power of modern science and technology to increase output and productivity.

today … Old-Age, Survivors, and Disability Insurance benefits equal 4.5% of GDP; that grows to 7% over the next 75 years. Does anyone doubt that we will be able to afford to devote 7% of our nation’s [REAL] output to provide a social safety net for retirees, survivors, and disabled persons? That leaves 93% of GDP for everything else. We have easily achieved larger shifts of GDP in the past without lowering living standards of the working generations.

Wray, L. R. 2009. “Social Security: Truth or Useful Fictions?” Tuesday, August 11, 2009

It is alleged by conservatives that US Social Security is “bankrupt”, because payroll taxes will not fund social security payments after about 2020.

The US can fix this alleged “problem” with Social Security simply by ending the peculiar and unnecessary accounting practice that says that US social security must be funded by one specific tax. [a tax that COULD and SHOULD be abolished]

http://socialdemocracy21stcentury.blogspot.com/2010/08/us-government-debt-and-social-security.html

The politics of Social Security today are exactly the same as they were when Roosevelt designed the system to be supported by its own tax.

If you are somehow able to secure your goal of abolishing a FICA tax deVOted to funding NOthing but Social Security, then you will get Social Security called a welfare program and you will then see it abolished.

So the consumer is going to lever up so they can consume $4.00+ gasoline? We are now in the Sawtooth Economy, where any step up in economic activity is quashed by the attendant rise in oil prices…

Alredy the Bakken is beginning to show signs of turning over, which is not suprise giving the dyanamics of the resevoir (see http://www.econbrowser.com/archives/2012/12/future_producti.html for what happens to production once you run out of acreage to drill)…

Despite the “Drill Baby Drill” Mantra, prices have not dropped except for a few mid-continent areas and most of the WTI-Brent spread has been pocketed by the refiners….

I think Flakmeister has the right angle. Any significant growth causes commodity spikes for various reasons, especially in oil.

Yup. A nice summation of the intractable problem here, from my main peak oil woman, Gail Tverberg:

http://ourfiniteworld.com/2013/01/17/ten-reasons-why-high-oil-prices-are-a-problem/

Only way out is to pour all free money into renewable energy, energy-efficiency (insulation, mostly), and conversion to things which can run on renewable energy (electrification, mostly).

Agree, completely.

Unfortunately, a desperate, last ditch –oh my God! Are you saying we have to recover the onside kick AND complete a 60 yard Hail Mary?– effort to save the planet before it enters it final death throws, would require long range planning and coordination.

Hard to believe that could happen, though, in a neo-liberal world built on short term –Casino– profit and –poison us– competition.

http://www.counterpunch.org/2013/01/25/natures-capital-is-the-limiting-resource/

There is another way, I think.

Better quality life via lower consumption.

But, corporate profits are at a high. If the US consumers come back it’s Dow 35000 and beyond, easy. Heck the Nasdaq may even see 5000 again in our lifetime. Life’s grand.

Yeah, but those profits are sustained by trillion-dollar deficits which we are now in the process of paring back. When the bottom line begins to deteriorate (and it will) consumers will not be able to make up the difference.

“Trust us. We are still deleveraging. It will probably be another five years.

Unless someone gives us a raise.”

US Consumer

Golly, this surely must mean the Fed-Primary Dealers can discontinue their mammoth wealth transfer scheme to the 0.1 percent known as “QE-ZIRP” tomorrow.

Fascinating to watch the Squid in action, with distribution of stocks to the suckers the goal after the huge engineered ramp since March 6, 2009: http://finance.yahoo.com/news/blankfein-rally-despite-people-under-150004649.html

They discontinue, and these financial markets will drop like a rock IMO.

I remember reading once about how someone upbraided J.P.Morgan for selling watered stock to hordes of lumpenvestors. Who of course lost everything in that swindle. J.P. Morgan is supposed to have replied: “when God made sheep He meant for them to get sheared.”

So a saying occured to me.

God made sheep to get sheared. Self-made sheep deserve to get sheared. Don’t be a sheep and you won’t get sheared.

In this context, “don’t be a sheep” means don’t buy stocks or stock funds under any circumstance. Endure the attritional losses to your “money” if you can . . .if you have any in a “bank” or a “bond fund” or wherever. The Fed is trying to torture you with slow steady losses into moving your money into their stock traps. Endure the pain as long as you can.

Of course, I am just a layman with no bussiness or financial or economics training at all. So what would I know? Well I know this . . . of all the several hundred cans of sardines I have opened and eaten so far over the last few years, not one can has had so much as one sardine sucked out through the side of the can. Nor has a single flake of tuna been sucked out through the side of one of my cans of tuna. Nor has a bit of salmon been sucked out through the side of one of my cans of salmon.

We are a gaggle of volunteers and starting a new scheme in our community.

Your web site offered us with valuable information to work on.

You have done a formidable process and our entire community

might be thankful to you.

“…the government sector needs to run a deficit or the economy contracts”.

People who care about the earth and personal liberty view the economy contracting and the government shrinking as extremely positive developments.

Especially if we can somehow shrink the economy from the top downward, to shrink-wrap it around the faces of the upper class so as to shut off their financial air supply.

What is ‘disposable income’? If you have some, could you please send it to me? I’ll spend it for you. I worked for my income, and none of it did I consider to be disposable: I spent it or saved/invested it. If you have money to throw away, congratulations, but why not give your job to someone who needs it?

Disposable income, I don’t think that means “trash”. I think the meaning is spendable money AFTER basic expenses of housing, clothing, heating/cooling, food, phone, etc. and necessary business/work expenses, car, various insurance, fuel, ordinary medical costs.

This varies of course. Some may not need Internet, or may use the Library or restaurant wifi, but it’s become a necessity for many. Most people probably think most of everything they buy is a need, not a want.

Basically, the money we have to buy stuff we don’t necessarily NEED, like Premium Cable TV, fancy clothes and jewelry, toys and electronic gizmos, prettifying home improvements, etc.