By Jerri-Lynn Scofield, who has worked as a securities lawyer and a derivatives trader. She now spends much of her time in Asia and is currently working on a book about textile artisans.

After 69 years in business, retailer Toys R Us filed for Chapter 11 bankruptcy this week– the second largest US retail bankruptcy ever.

Private equity’s role in causing the company’s demise is evident– as has been the case for a slew of retailer bankruptcies this year. Posts such as this one earlier in the summer by Yves mean the overall trend isn’t news to regular readers, see Private Equity Firms Sued Over Retailer Bankruptcies (and the earlier links included therein).

Nonetheless, many, including yesterday’s Financial Times are now also piling on the private equity culprit with respect to Toys R Us:

But the blame is perhaps to be placed most squarely on its private equity ownership. Toys R Us has spent more than $250m a year servicing $5bn in long term debt, which was “not a sustainable situation,” one investor said, as the company faced increasingly crushing competition from Amazon and Walmart.

After years of rearranging its debt burden, like other big leveraged buyouts of the pre-financial crisis era, it is presenting a restructuring under bankruptcy protection as a bid for freedom. Toys R Us says it now has a chance to bring its “vision to fruition”, announcing plans to invest in marketing and technology and even promising to raise store employees’ wages.

Private Equity Greed: A Plague on Retail Businesses

Likewise, Pam and Russ Martens don’t mince words when they describe the underlying cause for this year’s wave of retail bankruptcies in their Wall Street on Parade post, How Many of 2017’s Retail Bankruptcies Were Caused by Private-Equity’s Greed?

According to S&P Global Market Intelligence, there have been 35 retail bankruptcies this year, almost double the 18 retail bankruptcies of last year. The filing by Toys ‘R’ Us this week was the latest.

What many of these retailers have in common is that they were taken private in leveraged buyouts (LBOs) by private equity (PE) firms. Toys ‘R’ Us, Payless ShoeSource, The Limited, Wet Seal, Gymboree Corp., rue21, and True Religion Apparel were all LBOs. Gander Mountain can also be included in this list if you reach back to its 1984 LBO. Far too many LBOs are simply asset stripping operations by Wall Street vultures who load the company with enormous debt, then asset strip the cash from the company by paying themselves obscene special dividends and management fees.

Please permit me to reproduce their list of the largest retail names that have sought bankruptcy protection thus far in 2017:

- Toys “R” Us

- The Limited

- Wet Seal (Second bankruptcy filing)

- Eastern Outfitters

- BCBG Max Azria

- Vanity

- Hhgregg

- RadioShack (Second bankruptcy filing)

- Gordmans

- Gander Mountain

- Payless ShoeSource

- rue21

- Gymboree

- Cornerstone Apparel

- True Religion Apparel

- Perfumania

- Vitamin World

- Aerosoles

- Michigan Sporting Goods Distributors and

- Marbles Holdings LLC.

Private Equity Firms Lose Remaining Stakes: But Obscene Profits Already Booked

The FT article points out that in 2005, Toys R Us hired Credit Suisse, who arranged for a consortium of Bain Capital Partners, Kohlberg Kravis Roberts, and Vornado Realty Trust to do a leveraged buyout (LBO). The deal was valued at $6.6. billion dollars, with just over 20%– in cash, split equally– with the remainder financed by debt. (For those interested in delving into the details further, I include a link to the company’s April 2006 10-K.)

And, cry me a river, again according to the FT:

The three buyers who leveraged it are now expected to have their equity stakes wiped out in the restructuring. KKR and Vornado have written off their investment over time, while Bain has been carrying it near zero.

However, the losses to the firms and their investors are mitigated by the fact the buyout firms have paid themselves over $200m in expenses, advisory and management fees, according to SEC filings over 12 years of ownership.

Wolf Richter spells out in his post from earlier this month, Brick & Mortar Meltdown: Toys R Us Hires Bankruptcy Law Firm, in terms familiar to those who know how these stories go, some further details:

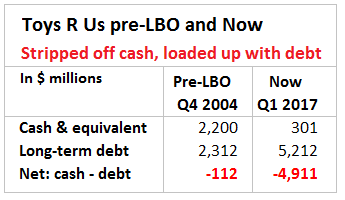

So here’s what the three PE firms did to Toys R Us: they stripped out cash and loaded the company up with debt. And these are the results: At the end of its fiscal year 2004, the last full year before the buyout, Toys R Us had $2.2 billion in cash, cash equivalents, and short-term investments. By Q1 2017, this had collapsed to just $301 million. Over the same period, long-term debt has surged 126%, from $2.3 billion to $5.2 billion.

This table shows the astounding results of asset stripping and overleveraging. It takes a lot of expertise and Wall Street connivance to pull this off. So whatever happens to Toys R Us, the PE firms already extracted their wild profits:

Table 1

Source: Brick & Mortar Meltdown: Toys R Us Hires Bankruptcy Law Firm.

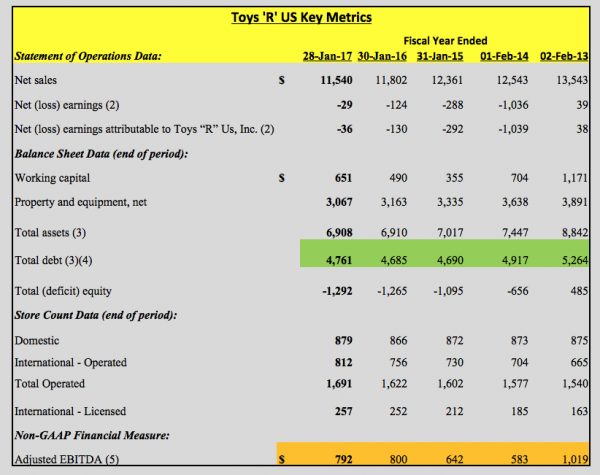

Unfortunately for the company, over the same period– 2004 through 2016– when its debt has ballooned, its annual revenues have remained essentially flat at just over $11 billion.

Permit me to quote at length from Wolf again:

After extracting enough cash from Toys R Us and loading it up with a debilitating pile of debt, the three PE firms tried to unload it to the unsuspecting public in an IPO in 2010. They were hoping for an additional payday, the icing on the cake, so to speak. But they had to scuttle their efforts due to “challenging market conditions.”

Yet toy industry sales have been “robust,” growing by 5% in 2016, and by a compound annual rate of 5% since 2013.

Incapably managed by the PE firms, Toys R Us has been losing market share in its struggle with online retailers, particularly Amazon, and with Walmart at every level, and with other toy stores. Nevertheless, if the company weren’t overleveraged and didn’t have PE firms leeching off it, its slowly declining revenues and thinning profits turning to losses wouldn’t be the end of the world.

In poking around and looking at some of the financial filings, I was a bit surprised to see how the company’s post-LBO difficulties were astutely anticipated in its April 2006 10-K (p. 20), in which the potential serious, negative consequences of the leveraging it had assumed were spelled out, including:

- making it more difficult for us to make payments on the debt, as our business may not be able to generate sufficient cash flows from operating activities to meet our debt service obligations;

- increasing our vulnerability to general economic and industry conditions;

- requiring a substantial portion of cash flow from operating activities to be dedicated to the payment of principal and interest on our indebtedness, and as a result reducing our ability to use our cash flow to fund our operations and capital expenditures, capitalize on future business opportunities and expand our business and execute our strategy;

- exposing us to the risk of increased interest rates as certain of our borrowings are at variable rates of interest;

- causing us to make non-strategic divestitures;

- limiting our ability to obtain additional financing for working capital, capital expenditures, debt service requirements and general corporate or other purposes; and

- limiting our ability to adjust to changing market conditions and to react to competitive pressure and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged.

Let’s Look at the Numbers That Sealed the Company’s Fate

For those more numerically inclined, let’s take a closer look at some of the numbers, which make the size of the debt albatross with which Toys R Us was burdened especially clear.

I’m going to draw heavily on this post in Seeking Alpha, Private Equity, Not Amazon, Killed Toys ‘R’ Us, from which the exhibits are drawn (which were in turn generated from relevant company filings, e.g., 10-Ks and 10-Qs).

Seeking Alpha also squarely blames private equity for the company’s demise.

Exhibit A – Top-line sales are down $2 billion over the past five years.

Source: Toys ‘R’ Us 10-K for year ending January 2017 (p. 24).

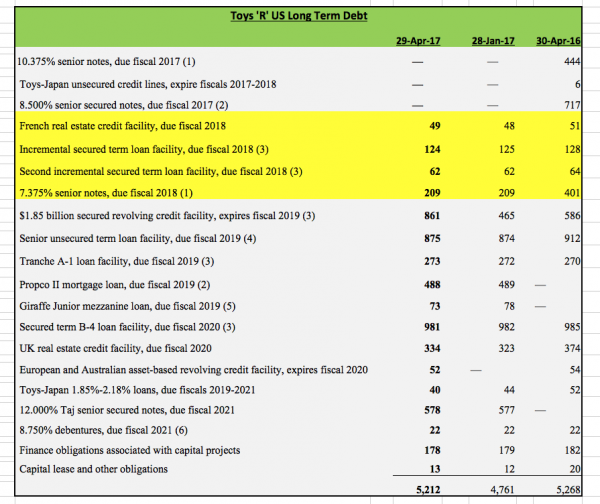

Exhibit B Long Term Debt

Again, relying on Seeking Alpha’s analysis:

$5.2 billion in debt as of April 2017 is insurmountable, given the weak operating performance. As you can see, there is $400 million in debt maturing in 2018. 7.375% coupon debt isn’t exactly low interest debt, but that is what happens when the greedy private equity firms lever up companies with “Other People’s Money” (OPM).

Source: Toys ‘R’ Us April 2017 10-Q (p.7)

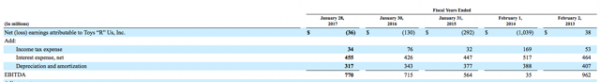

Seeking Alpha notes the company has been burdened with interest expense in the range of $425-517 million per year since 2013, making it very difficult to operate competitively (Exhibit C).

Jerri-Lynn here: Allow me to repeat the last item in that list of important consequences that flow from extreme leveraging as outlined in the company’s 2006 10-K:

limiting our ability to adjust to changing market conditions and to react to competitive pressure and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged.

Exhibit C Interest Expense

Source: Toys ‘R’ Us 10-K for year ending January 2017 (pg. 25)

Bottom Line

There’s probably very little in this post that will strike anyone following this story closely as new or novel. Nonetheless, the blame for this latest round of retail companycide is clear, so that I thought when I saw the venerable pink paper’s account, it was worth a short post.

It’s disgusting that this keeps happening over and over again.

One of those private equity sharks almost became the President of the United States. I’m not defending Obama; his period in office was marked by numerous misdeeds and a complete betrayal of the people who voted for him, but I think Romney would have been considerably worse.

I’m inclined to blame the lenders as much as the PE firms. Who is lending them money to leverage themselves enough to buy (and destroy) these companies? Without being able to leverage themselves the PE firms can’t buy Toys R Us and cant destroy thousands of jobs.

Time to revisit the 120-day preference clause in the Bankruptcy code? To what extent should managers and consultants of the limited partners or hedge fund investors also be held accountable for their participation in these schemes?

My own guess would be that the money comes from the trillions that the Fed has pumped into parts of the economy over the past decade or so. With so much money sloshing around the world’s economy looking for any profit at all and pushing up real estate and asset prices, I am betting that this is the source of the funds for these vulture equity firms.

Basic Minskian economics teaches us that if everyone else is willing to loan up on risky debt to buy an asset, you have no choice but to loan up as well if you want a competitive bid.

This dynamic is responsible for much of the Great Real Estate Boom.

It would be remiss not to point out the fundamental role that the Federal Reserve and overall politcal environment plays in these PE deals: low interest rates make bizarre financial contortions not only possible, but profitable. Hard money encourages hard-work, savings and investing, while easy money engenders “financial innovations”, profligacy, and dissolution.

So your saying jgordon that the quasi monetarists are screwing it up – ?????

disheveled…. um… hard money did not function as you suggest pre and post GD….

As many jobs will be lost when Toys ‘R Us goes out of business, as there are coal miners employed, so I offer a novel solution for both beleaguered industries in that kids only be given lumps of coal for xmas, no matter if they are naughty or nice.

Whenever I read these stories, and they are increasingly common as the OP points out, I am always reminded of the episodes of the Sopranos where Tony and the gang “asset strip” a large local sporting goods store to “pay back” the owner’s gambling debts; or the scene from Goodfellas where they do the same to a popular local bar/restaurant. There is literally no difference but for the extremely thin veneer of legality PE firms manage to conjure for their efforts. No one will ever get me to believe that these crooked firms didn’t learn this practice from the mob. They pioneered it and PE wrapped it in credentialism to make it appear legal.

Arguably the distinction between this and what Tony’s crew did to Davey Scotino (sp?) was that Tony’s boys never intended to repay the debt they piled on.

Or maybe not? Would not surprise me for an instant if these PE firms unofficially plan on having these bust-out companies default to some large degree. Can’t be as brazen or do it 100% of the time obviously.

Great episode, BTW. Been watching that series back again and just got to it the other day.

Truly fun, watching Tony and “the boyz” do their thing. Not so fun in reality. But in all honesty, if anyone thinks the PE boyz actually care whether the massive loans they took out ever get repaid I have a bridge they can purchase with a massive LBO. The evidence is the sheer number of Chapter 11 bankruptcies these PE firms engage in. What fascinates me is the dynamic between the banks that provide the LBO funds and the PE executives — at what point, if any, do the banksters care that they aren’t being paid back? Wait, who am I kidding? Since when do banksters care if the loans get paid back or not… after all, bonuses are based on unrealized profits (IOTW magic pixie dust).

So when do these PE punks start takiing dirt naps !

They’re all due for a biiiig recess.

@YankeeFrank…what does IOTW mean?

I looked up the acronym on various sites and all I can find is Image Of The Week or I Own The World – neither seem to fit your reference.

Thanks

I think it’s a typo, and should be IOW (In Other Words).

Not original, but the difference between the Mafia and Private Equity is that the Mafia always at least leaves some crumbs on the table.

A really decent sporting goods chain went the way of the Dodo a few years back, another victim in the usual way these things end nowadays

http://www.latimes.com/business/la-fi-sport-chalet-closing-20160416-story.html

Could someone please post one simplified paragraph detailing how private equity loads companies with debt to take them over, enrich the P.E.parasites and how this bankrupts the companies?

Something that the average American teenager or working class stiff could understand?

N.C. is my favorite website. The problem for me and others I have referred to it is that readers are expected to be already aware of all the details of financialization. Not everyone reading this, or who should be reading this, has a degree in economics or accounting.

I think you just provided what you asked for. And you did it with only a sentence.

Thank you, I’m guilty of the same assumption of (partial) knowledge.

What I’m thinking is along the lines of

What is private equity?

How does it work?,

Where does the debt come from?,

Who is responsible?,

How is money made off that?,

What are the problems with that?,

How does it destroy the companies?,

etc.

Explain it to my twelve year old.

“Complexity is often a device for claiming sophistication, or for evading simple truths.”

John Kenneth Galbraith

Don’t the limited partners like pension funds lose out when the company goes bust? Aren’t they supposed to exit the company when it IPOs or is sold to another company? So only the PE firm does well because of fee extraction. If this happens over and over again, then why do they continue to invest in PE?

Think of a spider with a fly in its web. The spider sucks all the juices out of the fly and then allows the dried out exoskeleton fall to the ground. Think of the limited partners as the spider. They don’t lose out at all. Their are nourished by the juices not the dried out exoskeleton that falls to the ground. And, of course, as was pointed out by someone above, the Bankers are paid based on the profits realized while the loan is current not the losses afterward. It’s all good. Our corporate mobsters are well fed and have the appropriate number of summer residences for someone of their social class.

So who’s resides the egg $ach$ ??

1) Borrow money

2) Buy a company

3) Have new company borrow a bunch more money

4) Pay yourself a large “management fee” from new company

5) Don’t worry about what happens to new company since you already made a lot of money

6) Repeat step 4 as many times as possible

Thanks for the very nice, succinct description. Here’s a variation on this theme:

1) Borrow money

2) Buy a retail business which owns many of its retail locations

3) Have the retail business sell the locations to a shell company that you already own

4) Pay your shell company an excessively high fixed income in rent from the retail business

5) When there’s an inevitable economic downturn, keep charging the same rent to the retail business

6) The retail business might be in trouble, but your rental income was too high, so you already won even if the rent stops coming when the retail business goes bankrupt.

All very nice, but you both left out the main reason the company went out of business, as far as informing the public is concerned.

7) Too much competition from the internets.

Sometimes, but not necessarily. If the company weren’t burdened by huge debt payments, it might be able to smoothly adjust to the competition from the internet. The company might become a smaller business, but it won’t have to declare bankruptcy.

But you know that, since you said:

A company that I worked at was almost sold, and we were very worried about being almost immediately unemployed.

As in we’re making great profits and we knew this because our bonuses told us so. But the equipment that the company had been building for years, and was partly the reason it was so profitable, made it worth more in piecemeal sales than the book value of the company as one whole. So you’re all fired. Where’s the auction block?

All this was around fifteen years ago and a business in no way threaten by the internet. I have been reading about vulture “investors” doing asset stripping since the early 90s. I think (but I don’t know) that this has been really going since the RJR Nabisco sale. It’s been building up speed since then as the growing number of parasites look for new hosts, or more politely called investments. That last is vicious, but how else should it be described?

Let’s ponder for a moment why these PE “geniuses” didn’t create an online toy-sales juggernaut out of the toys ‘r us brand; one that could compete with Amazon, etc. I mean, these PE dudes are supposed to be economics/marketing geniuses so let’s scratch our heads and wonder why this didn’t happen…… perhaps because the bust out was the main line of profit. They just don’t care about maintaining a successful business at all. PE parasites are not geniuses, they just have little to no conscience and an immensely corrupt government/finance nexus that permits them to do as they wish.

Bravo. This just about sums it up doesn’t it?

Funny how close this is to Hollywood accounting.

There it is a case of spinning up a “independent” studio to produce a movie.

Have said studio pay the big name studio to handle various tasks, at high rates.

Watch the movie rake it in, but thanks to the mentioned rates, still report a loss.

It’s my favorite website too. So glad the comments are back because I’ve learned a lot from the wise posters here. Such intelligent comments, that I was too intimidated to even take a shot at commenting for the first couple months here. :) I’m trying to learn and understand these things also, and after a year or so of visiting I feel I have a moderate grasp on understanding financialization, but it is very hard to try to explain to my family and friends, so I would appreciate it broken down in simple terms.

I’m feeling a bit confident today, so I will give it a shot.

1. A company is in trouble and the owner(s) let a Private Equity firm buy them out for a tidy sum.

2. The PE firm doesn’t care about the business or profits – it’s just a vehicle to enrich themselves.

3. They pay themselves big salaries and sink the business under the guise of ‘fixing it’. This includes selling off assets, laying off people – things like that. The ‘debt’ they drive the company in, is going right into their fat cat wallets.

4. After stripping, they try to pawn it off on someone else, walk off with a another payoff and leave some smuck holding the bag.

I think that’s it, but hopefully some well informed NCers can correct or add to it.

I’m not clear at all how they pull off #4 – for example is the company overvalued somehow?

Premise #1 is flawed. Most of the companies the PE firms bust out are not in any trouble at all until the PE firm gets their claws on them. Then trouble comes quickly in the form of massive debt loaded up onto the company’s balance sheet — debt that was used to finance the purchase of the company in the first place. This first step alone should be illegal — firms should not be permitted to load up another firm with the debt they incurred to buy the other firm. That is the first evil from which all the others spring.

Why do the owners sell to the PE in the first place – if the business is not in trouble? Do the top executives receive some huge lump of money – their greed is served- so they don’t care? Why does the Board of Directors of the company go along with this leveraged buyout? They don’t really care either? Are they forced to sell. What is the mechanism?

Maybe the founder of the company has retired or died, and his heirs want their money now. My understanding is that the PE sharks sometimes provide a big bonus to the CEO, and maybe also to a few other senior executives. I don’t know how common that practice is. So often the only people who care about the company’s future success are the people without any power.

Yes. The top execs do get paid (off). So do the lenders.

1) It may not be easy for a public company’s management to get the 8 — or 9 — figure bonus it dreams of while the company remains public. But when the LBO deal is done, any objecting shareholders get paid, too, when the company gets sold. That’s the (sick) beauty of the whole thing.

2) The lenders often get fees for arranging the financing, and can sell off pieces of the loans, either to other banks or as securities such as collateralized loan obligations. In this way they can get paid and escape future consequences. In addition, the capital structure of the new entity is usual set up so that the banks’ loans become the new “senior debt,” ie., they are the obligation that gets paid first in bankruptcy. So if banks hang on to a piece of this debt, they typically have a fighting chance to remain whole after bankruptcy. The new equity owners will take the “hit” (after already paying themselves) as will unwary holders of the more junior debt, which likely would be junk rated.

the decision is not so much with the exec, but with the board and the shareholders in general.

Keep in mind that it is the majority shareholders that form the board. And it is up to the individual shareholder if they want to accept or refuse a bid for their shares.

So basically it is a case of picking up enough shares from passive holders to tip the balance of the board. And they will usually be offered a multiple of what the market value of said shares are…

Thanks Yankee, I wasn’t aware of that!

@Yankee

Your specific point is where I get tripped up. If a PE firm loads up on debt to buy a publicly owned company, isn’t that debt in the name of the PE firm? How is it that a PE firm can then transfer that liability to the previously healthy firm? Is it that top management has to sign off (or get bought out/paid off) on this transfer? Even assuming that, it would seem that a transaction like that would lack economic substance; no one in their right minds would take on a crazy amount of high-interest debt if it puts the business in jeopardy of default, for little to no gain for the business itself. It almost sounds coercive, and being coerced into a transaction (even if you’re not literally being held at gunpoint) sounds like something that shouldn’t occur/be honored.

No, the debt can be (almost always is) in the name of the acquired company. The PE firms just needs to construct credible financials re: how the company will repay the debt. And, as said, as long as the upfront fees for the lenders are good, lots of technical problems go away.

Huh. That smells super shady. If a PE firm has to load up on publicly held stock in order to acquire a company, it seems a bit unfair that the liability is in anyone’s name other than that PE firm. Maybe it’s just pie in the sky thoughts, but that liability should be on the books of those who incurred it, and not passed along like a sleazy game of hot potato.

They do not transfer the debt directly.

What is done is that once they have a controlling interest the company is forced to sell assets and go into debt to make dividend payouts to the shareholders.

payouts that will allow the buyer to repay his debt with interest, and pocket a profit.

Legally it is all above board. Ethically on the other hand…

There is a defense – the Demoulas Market Basket story in Massachusetts is an example of one way to defend against it. An employee and supply chain united work stoppage renders the company unable to do business, in the Market Basket case, empty store shelves, no cashiers. Nobody in their right mind provides any money or inventory to a zero income entity. Attempt foiled.

1. Grab three other friends and each pony up 2.5 million dollars, for a total of 10 million dollar pool.

2. Use that pool as an asset to borrow money, at next to nothing interests rates (thanks QE), 200 million dollars.

3. Use 210 million as asset to purchase controlling interest in a company.

4. Take the company private.

5. Take 6 months to 12 months to :

(a ) transfer the 200 million loan to the private company

(b ) reorganize the business; close down parts of the business, fire employees and management, loot the pension fund, bust unions, etc.

(c ) Grant yourself and your three buddies a special dividend of lets say 150 million dollars. The beauty is it’s a dividend and not income. Therefore taxed at dividend rates and not income tax rates.

6. You take what’s left of the company public with 200 million of additional debt and an additional 150 million plundered and find no shortage of index funds, wall street/fund managers, pension fund managers, trusts, and foreign governments willing to invest “other” peoples money.

7. To net, with 6 to 12 months worth of effort, the four of you turned your 10 million initial investment into 150 million or a 1500% rate of return. Meanwhile everyone else is holding the bag. The diminished company spends the next 10 years making payments on 200 million debt and, in many cases, never able to make a payment beyond interest owed.

My try (simplified but not one paragraph):

1. Private equity “buys” ToysRUs for $6 billion. The 3 PE firms put down about 20% and borrow the rest from banks. Not too dissimilar from putting 20% down on a house and borrowing the rest. However, you don’t ask your house to come up with the funds to pay off the mortgage (unless it’s a rental property, which is a lot like an LBO). In a Leveraged Buyout (LBO), the PE owners use debt (leverage) to buy the business but then use (income from) the business to pay off the loan. If all goes well, the PE owners end up owning the entire business, having paid only 20% of the purchase price (just like the landlord uses income from tenants to repay the mortgage and ends up owning the house for the cost of the down payment). This is the most obvious way PE makes money. If the loans are paid off in 5 years, even if the value of the business is unchanged, the owners end up with a 400% return on their investment (roughly 80% per year).

2. This is all true regardless of whether or not the business reports ANY profits over that period. Because the interest on the debt is deductible as an expense, it is not unusual for the business itself to report losses even when the PE owners are getting rich. The losses come in handy because 1) they can provide tax credits that can offset profits elsewhere and 2) when employees clamor for a raise, the boss can say, “Well I’d like to but we are losing our ass, so obviously I can’t. And what I really need is for all of you to work harder for less money.”

3. Also, as Yves and NC have relentlessly (in a good way) noted, PE companies have become skilled at a variety of other ways to skim funds from a business. Maybe the 2 most notable are: making the acquired business pay various fees to the PE partners (transaction fees in the buyout, on-going management fees, dividends, etc.) and shifting the business’ real estate to a different company and then making the operating business pay “rent” to the real estate company. (In fact, there has been little mention of this in the TRU bankruptcy but I believe I heard previously that TRU’s real estate had been spun off to a different company.) I am pretty sure that PE companies “over-borrow” when they buy companies so that a good portion of the PE-financed part of the purchase price can be immediately “rebated” to the PE firm. So if PE borrowed $5 billion in the TRU sale, maybe they borrowed $500 more than they needed so that they could immediately (or shortly thereafter) dividend themselves half the purchase price.

4. So how does the operating company make the money to pay off the loans, or at least the interest on the loans, and other extra expenses? From its cash flow, cutting back on new investment, staffing, wages, etc. as necessary. Especially new investment. Remember that depreciation is a pro-rated share of previous and current capital spending (it isn’t all expensed in the year of the investment) so depreciation is a non-cash expense. A firm can make no new expenditures and will still have a depreciation expense that is a pro-rated amount of capital spending from previous years. So “depreciation” is often seen as a source of cash for PE. PE companies are concerned with EBITDA – earnings before interest, taxes, depreciation and amortization (A roughly same as D but often for “intangibles” such as “good will”). EBITDA tells them how much cash flow current operations generate that can be used to pay interest and pay off debt.

5. There are some PE takeovers in which, either through actions of the new owners or generalized asset inflation or upturn in overall business conditions or because the business was initially undervalued, the underlying business retains or increases its value, continues making money, etc. In these cases, PE owners eventually try to cash out by selling off the business to others later, sometimes even at a higher price than they originally bought it for. You hear a lot about these stories because both the buyer and the seller are happy (no one in the business press really cares what the employees think) and because this is the way business is supposed to work – buy an asset, improve it, sell it for more. But IMO this is really the secondary form of PE profit. I think most PE firms try to recoup their investment, and more, just from withdrawals from the business.

6. In other cases, after maximum asset stripping, bankruptcy is the final outcome. Bankruptcy is rarely unforeseen in these circumstances, except by the employees, creditors, customers and business press.

Don’t forget, PE Firms usually go after unusually cash rich firms or firms with well funded retirement portfolios or large real-estate holdings, using the excuse that because they have excess cash, retirement portfolios or too much real estate they must be inefficiently run. Therefore new (efficient) management is the best thing for the victim.

Then Steps 1 through 5 above are put into play.

There’s not much point in going after cash-poor companies.

Toys R Us isn’t going away; it’s a chapter 11 (reorg), not a chapter 7 (liquidation) bankruptcy, so Toys R Us (and more or less most of the retail jobs) will continue to operate, they just won’t have the LBO millstone around their neck when they emerge.

Their CEO commented on the unfortunate nature of the timing with holiday coming up, but said with rumors going around their suppliers, they had to do something to ensure they’d have adequate inventory on hand.

The rash of retail bankruptcies this year, and the redundancies of the narrative (it’s always Amazon’s fault) kinda makes me wonder who is profiting off these. Kirkland and Ellis, the bigtime lawfirm apparently advised the banks and/or Toys R Us both on the initial LBO in 2005, AND the decision to file for bankruptcy, and (I believe) is representing them in the bankruptcy proceedings.

these lawyers make money coming and going…

Ah, reminds me of Linen & Things….

From Wiki:

On May 2, 2008, Linens ‘n Things filed for Chapter 11 bankruptcy and closed 120 stores. In August 2008, Linens ‘n Things devised a plan to emerge from bankruptcy early in 2009. Under the plan, the retailer intended to reverse many of the strategies introduced after the company was bought by Apollo.

my mom worked there for over 10 years :(

Thank you very much for this post. I had a conversation about this very topic last night with an old friend of mine, and I couldn’t quite fully convince him it wasn’t just big, bad Amazon alone responsible for these retail bankruptcies. I think a lot of smart people who aren’t necessarily following politics or economics have an feeling that something is deeply wrong about this economy but can’t put their finger on it. NC is an irreplaceable source for good information and analysis.

After I had convinced him to at least look into the role being played by private equity and leveraged buyouts, he wondered why his wages had been flat for so very long despite his company (defense contractor) being so very, very profitable. It was nearing midnight and I had to go home and sleep, so I suggested he read Naked Capitalism as I bid him farewell.

Net sales are down to 84 percent of 2013 levels. Sometimes that indicates a retail establishment is an undesirable place to shop and customers stop going there when there is a better alternative. That’s what happened to Toys’rus. Why would anyone go to that madhouse when you can get the same shit at Target, Walmart or Amazon.

I have a friend who works in management at an Amazon “Fulfillment Center” in the Midwest. After listening to many tales of his adventures I can say that Amazon is a madhouse orders of magnitude greater than any brick and mortar retail establishment; the only difference is that most of the insanity is hidden (for now) from the view of the customers themselves.

And hence a reason NOT to be ‘fulfilled’ by the likes of Amazon …

STARVE THE BEAST OR REAP WHAT YOU SOW !!

I got a question. Why is it the companies (like toys r us) are lent more money and given more credit AFTER they have been taken over by these notorious private equity organisations? Why are the creditors and suppliers ignoring the risks, particularly given that its an established business model?

I think in some cases the lenders are in on it (?)

The LBO shops have connections to the banks that finance the deals, and they all collect.

I forgot to mention in my earlier post there’s another article on the Toys R Us bankruptcy that quoted a number of around $90 MM in fees for Lazard et al to raise the restructuring financing Toys R Us needed to make it through a successful chapter 11. So in addition to the lawyers, the bankers make out coming and going every time a new transaction is announced; each is an excuse to churn fees.

I heard the other day that one of my favorite stores (Nordstrom’s) was being handed over to the PE vultures. This is so sad. They have the best quality and although pricey it is worth it. I had a friend who used to work at Neiman in the IT dept. Sadly that place is in the weeds due to PE vultures too.

What a predatory snake pit this economy is! If only the average person were aware of all the elite theft that goes on in the economy . . .

Just as there is no pride in dressing up anymore, why should the people that built the enterprise to cater to that vanished clientele, really care all that much what happens to their business, sadly.

One should feel pride, and dress well. However, what is the purpose of pride in being an unimportant disposable cog, in a disposable company in an often evermore corrupt, and, or dying, industry; all the profits goes to an every fewer number of executives, or the lobbyists that are paid everymore, to bribe (donate to, pardon me) evermore legislators that change, block, and destroy any attempt to change all this? It is almost an insult to demand better of the employees when no one else does of themselves.

The crapification of clothing has been ongoing since at least the mid-70s, which has descended to another level with “fast fashions”. Quickly, and cheaply, made clothing meant to popular for weeks, months maybe and last just as long. Whole books have been written on the subject of how clothing has generally, and in America especially, been done in.

Just like every industry and product in America. Even if you can afford the immediate higher costs of the more expensive quality products, just where can you go to get them, especially made in the United States? And if you can find the clothes, tools, or anything else, I think that because they are not mass produced as before they are comparatively more expensive, and limited both in quantity, and styles. The book Overdressed: The Shockingly High Cost of Cheap Fashion by Elizabeth Cline is a good start.

The cliche about being slowly boiled alive keeps popping into my head; when I worked in retail back in the 1980s and 90s I read articles, had conversations with older employees and customers all saying the same as today. The clothes being today is not as good as the clothes made in the 80s that wasn’t as good as the clothes being made in the 70s which according to a few wasn’t quite as good as the 60s. Poorer quality, fewer sizes even, with evermore being made outside of the United States, or being moved from North to South, or just crapified in the same original factory.

This is all concurrent to the increasing relative costs of everything especially housing and medical care, increasing corruption, the increasing inequality, and decreasing income of most Americans.

So when libertarians, economic conservatives, or neo-liberals start talking about what needs to change, that we just need more of the same for the good times to happen again, I feel like something like bitter laughter.

And if they are aware, what are they supposed to do?

We are aware, and what can we do about it? (serious question)

The world is being reshaped by the dominance of finance over all other concerns. Profit abandons any concept of responsibility or social contract, in favor of what can be done. Forget utility, can we make more money if we do this? And what could make even more money? No more concerns seem to exist about ‘should we’, just ‘can we’. Finance has become a mindless virus, set to destroy it’s own growth medium.

In some form or another the PE buyout grift has been going on (forever) but recently since the 1980’s. Check out the wiki on Michael Milken. Who is now a respectable philanthropist worth a couple billion. The PE grifters learned from him how to avoid the prison sentences.

It’s called regulatory capture and control fraud.

We live in a very corrupt country but the corruption is woven into the fabric of the legal and regulatory system. The local cop doesn’t get a $50. payoff for a traffic violation. If there is money in the car they get to seize all of it for drug asset forfeiture. Same principle as buying up a company and gutting it with debt.

This is genetic with the Republicans, the Dems have to work hard and learn it.

The US thinks it has respectable corruption, unlike the Russian mafia state corruption or the old fashioned dictatorship corruption. We pretend that the corruption of the KSA , the ME oil despots, of the UK City of London financial world is respectable. Ha.

Our exPresidents take their paydays with $100,000 speeches from their corporate paymasters.

Respectable corruption and grift. maga.

Why can’t the creditors sue on the basis of the self-dealing by the PE guys?

I’m guessing they can’t, I’m just wondering how this all became legal.

Or is there just no one to file a suit because the loans end up getting securitized and sold off to greater fools like the pension funds (your friends at CALPERS)?

Something seems a bit fishy with the numbers. If the PE firms put in 20% of $6.6 billion…

…and “have paid themselves over $200m in expenses, advisory and management fees”

It would seem they lost over $1 billion on this deal.

Thus these statements seem wrong:

“After extracting enough cash from Toys R Us” (no idea what ‘enough” is) and …

“Private Equity Firms Lose Remaining Stakes: But Obscene Profits Already Booked”

In no way defending the actions of the PE firms, but unless I am missing something, it would appear to be a painful deal all around and that no profits were booked….

‘

Like the movie business! Some creative accounting ensures the right people get paid everything.

No matter how much gross profits a movie makes, it never seems to show a net profit, but the industry is often very profitable.

Not a word of this from MSM. Their story is “see capitalism is great, another company that could not compete (survival of the fittest) has been killed off”.

Like a great vampire squid. Come in and suck the company dry of cash and then leave the empty husks for the local communities to clean up the messes.

Think of what the company could have done with all that cash, instead of pay it to private equity. Talk about a drain on the economy. As Yves says, this is just rent extraction. Private equity is not adding any value to the economy by doing this. They are taking away from the company and it’s ability to innovate, as well as the cities and towns where empty TRU buildings will stand, with no property taxes being paid.

Great post Yves!

Isn’t this the same ToysRUs that somehow, back in the 1990’s, dissolved Petrie Stores Corporation, which had grown from a suitcase on the street corner of E. 105th Street and Euclid Ave., in Cleveland, Ohio, into a $5 billion per year apparel retailer, in a manner whereby none of the shareholders of Petrie Stores paid a penny in Capital Gains tax?