In finance, except for bequests, “legacy” means old and rotten. In banks, “legacy code” is ancient, creaky, customized software, often in Cobol which no one but codgers can coddle, but the bank can’t retire because it runs core operations.1

In investing, it’s even worse. A “legacy asset” means a holding with a loss that has not been recognized. That means it is currently carried on the books at an inflated value. See Investopedia’s definition:

A legacy asset is an asset that has been on the company’s books for a long period of time. A legacy asset has generally decreased in value to the point of a loss for the company…Financial companies may experience legacy assets in the form of investments that have lost their value or loans that will not be collected and so have been characterized as bad debt.

So what might CalPERS’ legacy assets be? See this topic from CalPERS’ Investment Committee meeting next Tuesday, to be discussed in closed session, under Item 4:

The fact that CalPERS’ staff, which normally never talks to the board about either bad news or matters like valuation, nevertheless feels compelled to Say Something, suggests that this problem is material, as in big enough to impact CalPERS’ reported funded status.

My guesstimate is that means the values that need to be written down if CalPERS were to come clean are at least enough to move CalPERS official funding level by 0.5%. CalPERS’ total assets are roughly $400 billion, which amounts to about 70% funded (before the bloodbath of the last two weeks). (0.5%/70%) x $400 billion = $2.9 billion.

Note that Mekata is CalPERS’ private equity consultant, so you can be sure that private equity dogs are a major focus. The discussion could also include overvalued doggy infrastructure and real estate holdings, as well as investments via supposed hedge funds like Chatham that have been making private equity like its stake in American Media and its plan to take over McClatchy.

Also observe that the “legacy assets” discussion is listed on the agenda as an “Information Agenda” item, meaning the board is merely being informed, as opposed to being asked to do anything. That is yet another proof of CalPERS’ board acquiescing to a continuing staff power grab. A competent oversight body would insist on finding out why a mess like this happened in the first place and would want at least a say, and ideally to be in charge, of what was done about it. Remember, having a material level of overvalued assets would mean that CalPERS has been misrepresenting its funded status in its published financial reports, possibly for years.

Another implication of deals with unrecognized losses is that CalPERS may have been cheated by overpaying so-called carry fees. Most US investors allow the general partner to keep 20% of the profits on a particular deals once a hurdle rate has been met. But the carry fee is supposed to apply to the total funds; letting the general partner extract its cut on a deal-by-deal basis is a significant concession.

The limited partnership agreements therefore have provisions that in theory allow the limited partners to claw back overpayments of carry fees. Losses on the original amount invested in a deal would trigger a clawback on carry paid out on earlier deals. But many investors pay no attention when funds are finally wound up. Moreover, even when the investor realized it’s owed money, the fund manager will arm-twist the investor not to demand a cash payment, even though that is what he is entitled to. Instead, the usual finesse is to offer a deal on the next fund…..pre-commiting the investor to sign up. And as we saw with CalPERS’ pay to play settlements with Apollo and CIM, fund managers feel entitled to renege on those obligations.

Moreover, CalPERS’ staff and board looks again to be committing a crime by discussing a topic in closed session (as in hiding it from the public) when it lacks legal authority to do so. Specifically, CalPERS has to cite its legal justifications for relegating a matter to closed session, which for all the closed session matters are California Government Code 11126(a)(1), (c)(16) and (e)). (a)(1) is about hiring and evaluations of employees, which is off point unless someone is in serious trouble, and an outside investment consultant would not be a proper bag man. (c)(16) is about investment decisions, but no decision is proposed since this is an information item. (e) is pending litigation, which seems unlikely.

These long-standing overvaluations almost certainly result from the original sin of “alternative” investments, that of buying stakes in funds that hold illiquid assets, and then letting the fund managers do their own valuations. This is tantamount to letting students grade their own exams.

In strategies for investing in liquid assets (including derivatives), funds are required to provide independent monthly valuations. But in private equity, the firms have persuaded over-eager investors that they can be trusted to provide their own marks. We’ve discussed how academic studies have found that private equity fund managers inflate valuations at predictable times: when raising a new fund, during bad equity markets (like now!) and late in the life of a fund. Specifically when the fund manager is holding on to tail end Charlie assets, unable to find any buyer, they do not want to recognize the loss outside a sale. It is important to be able to give a shaggy dog story as to why it made sense to get out at a loss rather than continue to hold on hoping for a bigger chump to show up.

So what might some of these legacy assets be?

CalPERS does have some very small holdings left in funds going back to the 1990s, but those are too small collectively to be triggering this discussion. There may be some big fairly recent losers, but CalPERS tends to take its lumps only when an investment is pretty old, like the over $500 million in losses it took in 2018 on a 2008 timber deal.

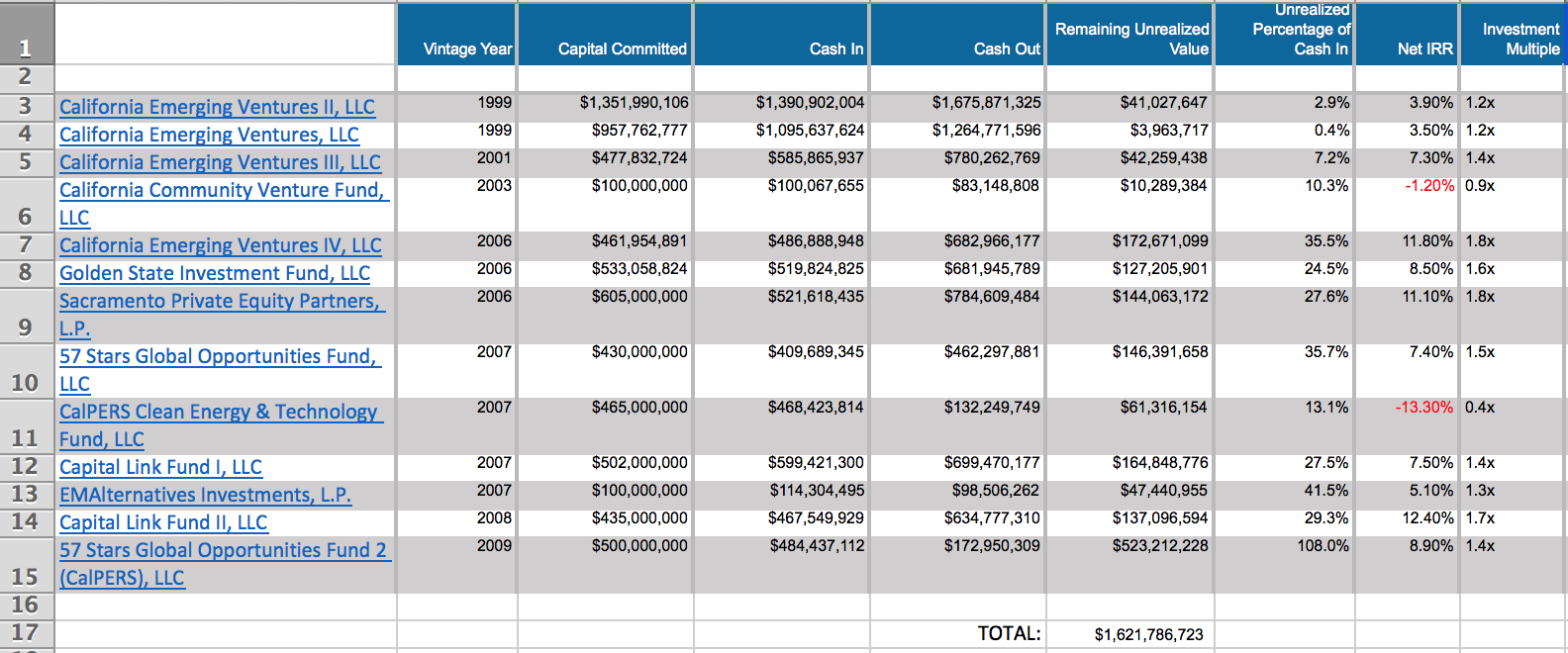

Here are some candidates. These are fund of fund investments that CalPERS made over a decade ago, meaning the remaining amounts (see the “Remaining Unrealized Value”) is suspect. Fund managers have strong incentives to sell assets early in the fund life, by year 4 or 5. First, it helps to show that you’ve made buys you can exit when going to raise a new fund. Second, selling earlier is rewarded under the questionable but widely used internal rate of return (IRR) computation.

Another reason these funds are prime candidates is that they were made with questionable rationales or processes. Former state Treasurer Phil Angelides, who was on the board from 1999 through 2007, was a big proponent of having CalPERS invest in California. And even though the giant fund might in theory have an information advantage, the reality is that those investments run the high risk of being politicized.

In fact, these fund of fund investments, by definition, were not made by CalPERS, but instead amounted to CalPERS hiring fund managers who would in turn invest in other fund managers. So the idea that there was any information advantage is questionable. (CalPERS claims it got fee breaks so it was not losing out on excessive investment costs, which is the usual reason that fund of fund investments are a bad idea, by imposing another layer of fees and costs, but I have not attempted to verify that).

Those of you who follow CalPERS will notice that this is the strategy that recently departed Chief Investmet Officer Ted Eliopoulos adopted, save he intensified the focus on bigger and fewer funds. CalPERS consultant Meketa deemed that approach to have been a failure. Even though it may have been possible to implement this approach better, it seems that CalPERS obtained no institutional learning from whatever mistakes were made, particularly with hiring outside managers.

Nevertheless, Angelides got CalPERS to commit to the California Initiative, which allotted $1 billion to private equity investments in California. That program did allow for the fund managers to make direct or co-investment, and not just invest in other funds. The California Initiative also sought to invest in “underserved markets” and to achieve what were called “ancillary benefits” by doing good, such as favoring minority and women owned firms.

A former CalPERS employee said that most of the older funds in this list (pre 2006 vintage year) come out of the California Initiative, such as all the California Emerging Ventures funds, California Community Ventures, and the Golden State Investment Fund.

In 2006, CalPERS made a strategic review of private equity. It recommended that CalPERS staff focus on making larger investments in bigger funds, and that the other components of the program that required lots of due diligence be done with extermal managers who would pick fund managers. The focus of the outsourced management was to focus on growth segments and emerging managers. CalPERS Clean Energy, EM Alternative Investments, and the Capital Link funds were part of this program.

However, the two investments that look particularly sus are the two 57 Stars funds, which were part of the California Initiative and a successor effort. Note that the last one, had a $500 million commitment in 2009. In 2009, CalPERS was severely liquidity constrained, to the degree it was having trouble raising cash to pay benefits. Why would it make a big commitment to a new fund then? That fund now has $523 million of unrealized value, a very high proportion of the $1.6 billion total for the funds in our little spreadsheet and significant all by itself.

Mind you, I am not saying the total remaining amount of $1.6 billion is all a loss. But you can be pretty sure it needs a large haircut. Nor am I suggesting that this is all of the legacy assets; it’s impossible to infer that from the outside. But these obvious ones confirm the notion that CalPERS does have a lot of junky items on its books that it needs to dump and/or write down in a big way.

Ironically, the recent market bloodbath is a perverse aid for CalPERS in dealing with its legacy asset mess. Staff might have been planning to bleed the markdowns out over time which would be legally fraught from a financial reporting and fiduciary duty standpoint. Or staff might be proposing a dodge of the sort that “We know they need to be written down but since we don’t have a solid new valuation, we aren’t obligated to do so yet.”

That it means these holdings will now be almost impossible to ditch and thus warrant even bigger markdowns than when staff realized they needed to ‘fess up to this problem. The flip side is the magnitude of losses across CalPERS portfolio means cleaning this problem up could be buried in the bloodletting and CalPERS executives might get away with having lied about their funding levels for years.

____

1 This is a huge problem for banks, and they’ve collectively spent tens of billions on everything from consultant snake oil to large and very serious projects and not gotten much of anywhere.

Seems like “CALPERS, the gift that keeps giving” needs to be rebranded to “CALPERS, the c-f*k that keep taking”.

Legacy asset? The mind reels at the sort of legacy assets that CalPERS may have invested in over the years. Since most seem to have come from the 1990s that probably means no buggy whip manufacturers here. But the 1990s? What investments could CalPERS have made here? Maybe corporations researching better floppy disc technology. Perhaps a corporation to deliver VHS tapes in rapid time. Large financial investments in MySpace maybe. A fax machine manufacturer or two as well as a cassette tape company. I suppose that CalPERS have had their fingers crossed for many years now hoping for “The Big One” to hit so that they can claim that their financial records were partially destroyed.

That term “ancillary benefits” does confuse me. Investing and by doing good by favoring minority and women owned firms? For the later, would a corporation owned by Nancy Pelosi count as she is a woman? How about investing in a company owned by Kamala Harris? She hits both the minority and women tick-boxes here. How about Henry Jones before he was elected? There is a blood bath going on in Wall Street right now and it is red right across the board. If they were half smart (yeah, I know, I know) they would fess up to everything in one hit and let the news just become part of the background static of the present market. With Washington starting to sniff around CalPERS because of that Meng character, they should really clear the decks but fast.

TBH, the worst legacy asset Calpers has right now is Marcie & co.

Attorney General Becerra is going to be all over this!

Enough, the Cavalry ain’t coming, the overwhelming majority of the public employees couldn’t care how CALPERS operates – they have first dibs on your wallet, so with that backstop, what’s the worry?

“having a material level of overvalued assets would mean that CalPERS has been misrepresenting its funded status in its published financial reports”

If what you report turns out to be true then all of us that depend on our retirement benefits are in serious financial trouble.

I’ve thought that for some time now, that CalPERS was behaving corruptly, but I didn’t think the Board would look the other way when presented with actual “cooking of the books”.

All the CalPERS executives and the investment staff get incentives based in part on returns. So if the values have been “cooked” for years, so has their pay.

So the information remains hidden year after year because there is no incentive for staff to tell the truth.

Cooking of the books is a CRIME because they obfuscated the truth in order to increase their pay or to hide incompetence.

Somebody get word to Buenrostro in lockup that his old CalPERS pals will be joining him soon enough.

I never thought that I’d be rooting for the re-election of Donald Trump, but if Biden is nominated that’s just about the only way that the U.S. Justice Department is going to go after these fraudsters who by all appearances have been goosing their compensation through over-valuation of Private Equity and Real Estate partnership assets. Too much of the CalPERS trust fund has been siphoned-off to the Democrats, why successive hack Attorneys General Jerry Brown, Kamala Harris, and Javier Basura have failed to lift a finger even in the face of a CalPERS CEO sentenced to federal prison…

Follow the money…

Due to the reconfiguration of the Investment Committee and the change in the board meetings schedule, the IC can no longer DO anything other than approve minutes and agendas. Whether the chair of the IC is prepared to “report” at the next Board of Administration meeting in a way that brings an item like this one up for discussion and a vote instructing staff remains to be seen but seems highly unlikely. Seems like staff has succeeded in silencing, or maybe neutering the board when it comes to investment oversight.