CalPERS’ private equity initiative is looking a lot like Brexit.

Just like Brexit, CalPERS launched its private equity scheme for political reasons, namely, to reduce transparency since the public agency is too thin-skinned to take well-warranted criticism, yet too lazy to up its game (CalPERS failure to offer a coherent justification makes it hard to reach any other conclusion). Both were undertaken with a remarkable lack of thought or investigation.1

Just like Brexit, CalPERS keeps running into realities that undermine its claims about how great things would be, like having to admit it will pay higher fees (lowering net returns), and that one of its planned new funds, one that will engage in Warren-Buffet-style long-hold investing, will earn less than CalPERS’ current private equity approach. On top of that, there is no reason to expect CalPERS’ other pet idea, “late stage venture capital” to do all that well, since late stage venture capital companies today are as mature as tech companies that went public in previous decades. Why should CalPERS expect return premiums to public companies from companies that are essentially public companies?

Just like Brexit, CalPERS is unable to either resolve or live with contradictory aims. In Brexit, the glaring example is the Irish border, where the UK does not want a hard border, but also rejects having Northern Ireland be subject to EU rules on trade. With CalPERS, the giant fund fantasizes that it will be able to protect its interests with a mere advisory board, when its only leverage is likely to be to stop providing more funds or dissolve the ventures, both of which are such radical moves that CalPERS would be unlikely to use them until results became visibly poor, as opposed to merely sub-par.

Just like Brexit, CalPERS is falling back on cheap sloganeering to cover ideas doesn’t hold up to scrutiny. For instance, CalPERS keeps saying it needs private equity for its returns. Yet there are other approaches that would deliver private-equity like returns for the portfolio, such as public market replication of private equity or applying more leverage to the entire portfolio. More important, if CalPERS’ real objective were returns, it would not be dithereing about with creating a new middleman with less experience than private equity firms but where the “talent” would expect to get economically similar terms to what they’d get if they launched their own fund. The way to achieve the highest returns possible from private equity is to bring most or all of it in house. CalPERS’ refusal even to discuss this alternative says the pension fund has other objectives that it is keeping hidden. It is hard to see how any covert motivations could be aligned with those of beneficiaries; otherwise, there would be no reason to hide them.

And just like Brexit, CalPERS is more than two years into its process and is hardly any further along than when it started.

Yet, again like Brexit, CalPERS seems to regard it as politically impossible to drop the idea.

CalPERS CEO Marcie Frost effectively said in recent remarks to the press that CalPERS has made no progress on its private equity “new business model,” making her a provincial competitor to UK Prime Minister Theresa May in protracted exercises in non-delivery. However, a big advantage that Frost has is that the captured trade press is all too willing to take up CalPERS’ misdirection spin.

Consider an early May article in Top 1000 Funds, CalPERS wants PE ideas for new entity. A not-very-close reading shows Frost falling back on a key element of CalPERS’ branding, namely, casual lying. Frost tries to act as if CalPERS is in the early phases of developing its private equity scheme, when in fact (like Brexit), CalPERS is again going over well-trodden ground, acting as if repeating the same steps will somehow magically lead to a different outcome.

Let’s start from the top:

The CalPERS’ board has approved the first step in the creation of a new private equity model, and now the fund’s CEO, Marcie Frost, is looking for advice on how to structure such an entity.

This is false. The CalPERS board only gave approval for the staff to continue to explore the “private equity business model”. And this isn’t a “first” anything. The board vote in the April open session was similar to what was approved in last May’s closed session. That became largely public as a result of Frost and then Chief Investment Officer Ted Eliopoulos acting as if the board had green-lighted the concept, leading to board member objections and a walkback by Frost at the following board meeting.

And what is this blather about “looking for advice on how to structure such an entity”? CalPERS has been discussing “structure,” as in legal structure, for well over a year. Silicon Valley fixer Larry Sonsini sent a memo to Marcie Frost, Ted Eliopoulos, and John Cole, who has been managing this initiative, titled “Private Equity Direct Investment Entity: Investment Structure Roles and Responsibilities”. You can view the document, which was presented to the board in a May 2018 closed session, here. CalPERS hired a big ticket lawyer to give advice on the legal structure, among other things.

So is Frost admitting her dalliance with Sonsini was a complete waste of time and CalPERS’ money, and she has had to throw out all of his work product and start from scratch? And if this isn’t the case, why is Frost lying by pretending she is starting afresh?

The article then does mention that the giant fund’s fortune have improved somewhat due to former Governor Jerry Brown having provided $6 billion of pre-funding, but rather than calling that a mini-bailut, the author blandly depicts the state moving to alleviate CalPERS underfunding as an “improving liquidity position.”

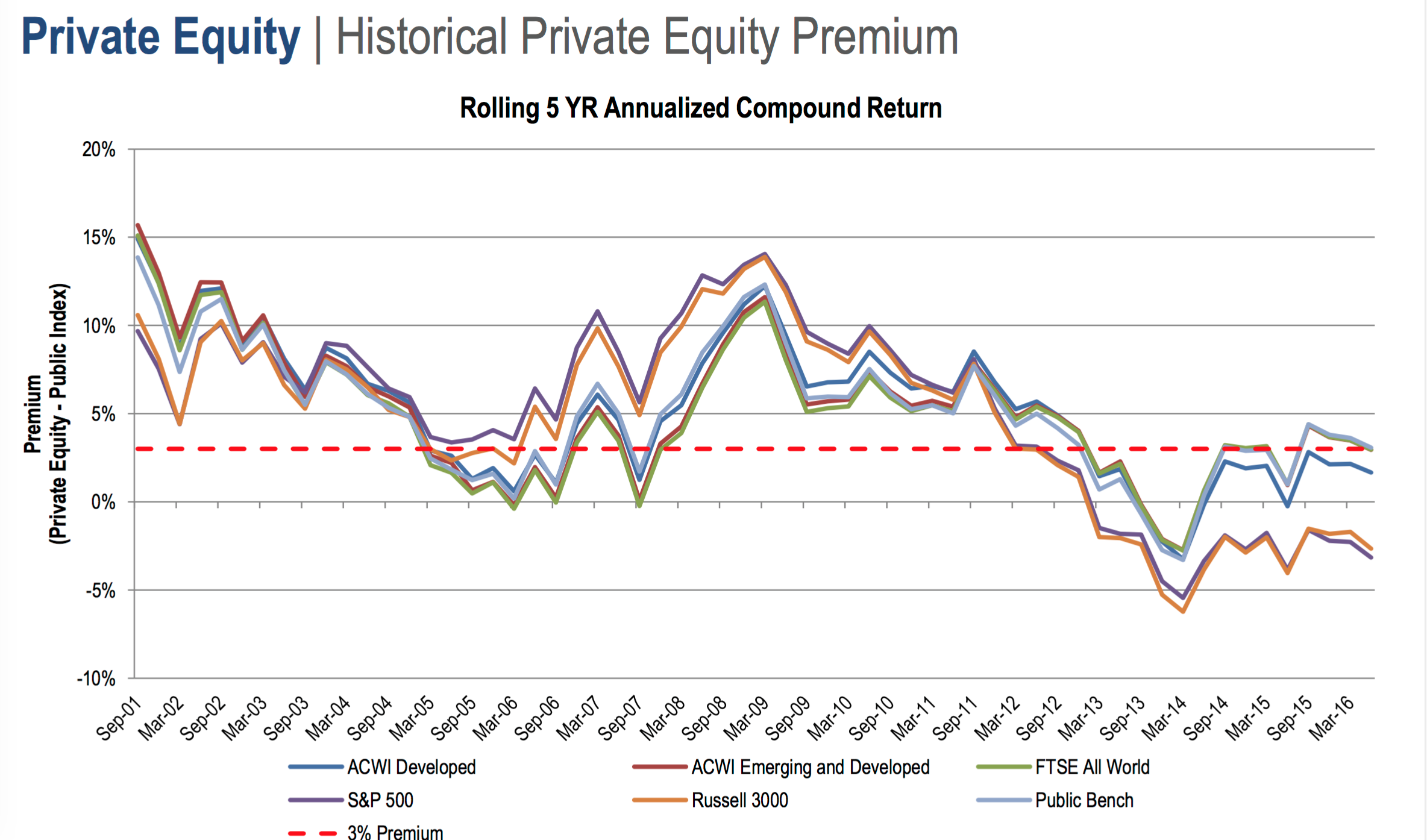

The next paragraph returns to private equity, mentioning that it ” is also the only portfolio forecast to beat its return target over the next 10 years.” The author is either so captured or so inattentive as not to know that CalPERS resorted to lowering its benchmark to preserve the fiction that private equity was producing enough in the way of return to justify its extra risks. From a 2017 post:

Recall that CalPERS has failed to meet its private equity benchmarks for the last ten, five, three, and one years. CalPERS is widely considered to have ready access to fund managers and to be disciplined about fund selection. It’s hard to think that many investors would do meaningfully better than CalPERS; indeed, PCA said in September that CalPERS did better than an industry peer group index.

But private equity is a high-risk, hoped-for high-return strategy. And yet the benchmarks that have been used in the industry for decades show that private equity hasn’t delivered the returns that go along with the risks..

CalPERS has not just fallen short of these targets. It has fallen short by a gaping chasm of several hundred basis points for the ten, five, three, and one year measurement periods….

Ironically, in a April Investment Committee presentation, CalPERS admits that private equity hasn’t been earning enough to meet its idiosyncratic risks of late, measured against a host of equity indices:

In this board meeting, CalPERS used a con that it had passed off on the board before, that of using an artificially low volatility estimate. CalPERS later “revised” the benchmark to lower the risk premium for private equity from 300 basis points (3%) to 150 basis points (1.5%).

The next sentence is another eye-popper:

Frost said the board’s approval in the first step of a separate entity to invest in private equity was an important signal the fund was embracing innovation.

As we indicated above, the board made no new commitment. But on top of that, Frost is engaging in Brexit-like Groundhog day behavior with her flogging of “innovation”. First, innovation isn’t a magical cure-all. History is full of terrible innovations, such as radium-infused medical tonics, asset-backed-securities CDOs (the kind that blew up the global financial system), and New Coke. Second, what CalPERS is planning to do isn’t innovative. It’s just a separately managed account, which CalPERS could get from any established private equity fund manager with far less brain damage. And third, Frost abandoned the “innovation” positioning when it polled badly among CalPERS beneficiaries, leading CalPERS to do a 180 and present the “new model” as “tried and true“. Maybe Frost thinks she can run one type of messaging to finance professionals and another to CalPERS members. That sort of move didn’t work very well for Theresa May, who found out the hard way that EU leaders and negotiators were reading the UK press with considerable care.

But Frost has worked her way up to the most damaging admission:

Now CalPERS is a [sic] looking for a team, or individual, to join discussions and workshops to help figure out what the detail of this new private equity venture could look like.

“Come and talk to us about your ideas,” she said. “We need every access point in private equity we can get. 7 per cent is a high target and we know we have to take some risk and have to understand those risks.”

This is an admission of failure. CalPERS did a big listening tour which it doggedly presented as serious research. It was then caught out by Bloomberg in September 2017 trying to outsource the entire scheme to Blackrock. CalPERS then engaged Larry Sonsini later that fall. In December, CalPERS launched an “invite only” “strategic partners search” for an unjustifiable fund of funds program that was again designed to favor Blackrock.2

With Sonsini installed, CalPERS developed a napkin-doodle level structure for the new entities. CalPERS also began talking to potential fund managers. At the beginning of January of this year, Bloomberg broke the story that CalPERS had already been recruiting potential “talent” and was in advanced discussions with two former Silver Lake partners, among others. This suggests that CalPERS had been out recruiting for at least a couple of months, without any board approval. As we wrote in January:

CalPERS staff is operating in an astonishingly high-handed and incompetent manner. The only rationale for trying to recruit candidates before staff has finalized the private equity scheme and the board has approved it is to strong-arm the board, by trying to argue that these great picks won’t wait much longer. It also serves to condition board to see the venture as a given by getting them to focus on implementation issues and divert their attention and energy from fundamental “Why are we doing this at all?” questions.

So it is flat out dishonest for Frost to pretend that she is soliciting interest for the first time.

But far worse is that Frost yet again is showing how inept CalPERS is at going about it, which (again shades of Brexit) is also why it is going in circles.

For anything non-trivial, competent organizations do not tell potential vendors, “Tell me what you think I ought to buy”. That is an invitation to be taken.

Similarly, most professionals will tell you the worst clients are the ones who don’t know what they want, or make 50,000 foot requests that aren’t deliverable (“I want to make a really good acquisition at a cheap price3″). Conversely, the best ones are very clear about what they want from a project at the outset and have done enough homework to be realistic about timing and budget.

Statements like the ones Frost has made to the press scream that it will be torture to getting anything done with CalPERS, which may have a lot to do with why Frost is still spinning her wheels.

CalPERS has no justification for not going through the discipline of having a public solicitation process. First, it would force the fund to articulate what it wants and would give potential candidates greater confidence that they won’t be wasting their time if they express interest. Second, an open, competitive process is the best way to get good results for the funds. CalPERS keeps fetishizing the importance of prospective partners sharing CalPERS’ ESG goals. Anyone who is anti-transparency isn’t credible as being a supporter of good governance, the “G” in ESG.

But this gets back to the question we raised at the outset: why is CalPERS so doggedly pursuing this scheme when it’s showing that it isn’t getting anywhere with it, and rejecting the idea other public pension funds are moving toward and Dr. Ashby Monk has recommended forcefully, that of bringing private equity in house? CalPERS keeps trying to peddle falsehoods, like it can’t pay enough (not true, according to CalHR, CalPERS can pay whatever it needs to as long as it can substantiate the compensation level) or the equally barmy excuse that no one would work in Sacramento (they don’t need to: how hard is it to have an office in San Francisco and later New York?). It would admittedly take a long time to build the skills to bring most of the investments in house. But for CalPERS to bring private equity in house is a smaller leap in capabilities than when commercial banks decided they wanted to get into investment banking. Yet in a decade of concerted effort, the biggest players had made significant inroads.

So if the analogy to Brexit holds true, Frost should take a hard look at what it has done to Theresa May’s reputation. May is still Prime Minister only because no other Tory wants the job.4 Frost will not be so lucky if she can’t deliver on her private equity scheme, or alternatively, tries to ram it through without remedying its considerable shortcomings.

____

1 From one of several discussions of CalPERS’ claims that it had done bona fide research, which it first presented at a July 2017 offsite:

CalPERS’ staff engaged in yet another snow job with the board in trying to pretend it had done a bona fide strategic review. The centerpiece was (and I am not making this up) a “listening tour” where CalPERS consulted with 50 Big Names on private equity, many of whom would have absolutely no reason to know anything relevant, such as Jeff Immelt of GE and Jamie Dimon as well as Steve Schwarzman of Blackstone and critics like Ludovic Phalippou of Oxford. They asked for their views on private equity topics as well as “What would you do if you were CalPERS?”

By contrast, the last time CalPERS thought about making a big change in its private equity strategy, it hired McKinsey.

As anyone with a modicum of business training, or even some common sense, would recognize, this was a garbage-in, garbage-out exercise intended to provide the sheen of brand name validation. People like Immelt are too removed from the industry to have much if any insight; general partners like Schwarzman clearly have an agenda, which is to keep limited partners giving them money and paying fat fees. In addition, none of them know CalPERS well enough to provide specific advice.

It’s another sign of how little respect the staff has for the board that it didn’t deign to provide a list of its interviewees, but merely mentioned the names cited above plus Larry Fink of BlackRock and Dr. Ashby Monk from Stanford.

We later learned that Professor Phalippou was shocked that his chat with a CalPERS employee was being depicted as research. Phalippou had been invited for a drink and the “research” consisted of a 45 minute chat in a pub.

2 The original documentation for the solicitation made clear that only six invited firms should apply. When that was exposed, CalPERS then took the position that anyone could submit a proposal, when it was obvious that that was just a face saving gesture.

3 A common request from Japanese corporations circa 1988.

4 Save the widely-loathed Boris Johnson.

Let me summarize my understanding of PE and Hedge Funds:

PE and Hedge Funds returned extraordinary amounts of money to investors in the nineties;

As a result quants and investors piled in and all subsequent returns began moving toward the mean;

Pension funds wanted in on the action and agreed to the “trade secret” and moving measurement nonsense of their new investment advisors;

Consequently, pension funds assumed an increased amount of risk (volatility) and allowed their funds to load up on illiquid assets and other junk;

We are at the mean where the return on public and private investment approximate;

There is no longer any “value added” by PE and Hedge Funds;

Pension funds have maximized their risks at the price of minimizing their gains.

Any additions, subtractions and references would be appreciated.

For private equity, it isn’t even “in the 1990s,” which a casual reader would think means the entire decade. Private equity deals of the 1980s tanked during the nasty 1990-1991 recession. Banks took huge losses on their loans. General Electric, which had been a lender on some deals as well as an investor in others, set up a large workout unit. But the S&L crisis (which was actually related, since the Milken thrifts were also stuffees for LBO debt) dominated the news,so the financial damage to LBO lenders didn’t get the attention it warranted.

The economy of the early 1990s was still pretty sluggish. It was the vintage years of 1995 to 1999 when “private equity” deals performed spectacularly. The industry’s current reputation rests on that window.

Thank you Yves. I am annoying the staff and board of my underfunded pension fund about the continued underperformance of the PE investors that they insist on contracting with. Moreover, they are prepared to double down on the cash they allocate to these knuckleheads.

I am trying to alert a number of my friends who are also fund beneficiaries. Any academic studies or referenced graphs demonstrating poor returns, high risks extraordinary fees would be helpful.

I am remiss in not having featured the work of one of our readers did as part of a team in conjunction with a course and competition at Stanford Business School. They developed a strategy using 5 Vanguard funds. It outperformed 90% of the public pensions.

We’ve regularly written up studies that question private equity fees and performance. See:

https://www.nakedcapitalism.com/2018/08/oxford-professor-phalippou-since-2006-private-equity-produced-sp-500-returns-reaping-400-billion-fees.html

https://www.nakedcapitalism.com/2017/04/skepticism-about-private-equity-fees-going-mainstream-pew-and-calpers-versus-yale-and-industry-stalwarts.html

https://www.nakedcapitalism.com/2014/08/hedge-fund-private-equity-fund-rent-seeking-high-fees-crappy-performance.html

https://www.nakedcapitalism.com/2015/09/public-pension-fund-study-high-fee-strategies-like-private-equity-lose-billions-compared-to-cheaper-alternatives.html

I am pretty sure there is a 2017 update to the 2015 Maryland study that reconfirmed its earlier conclusions.

Ludovic Phalippou of Oxford is very accessible. I suggest you e-mail him to set up a time to speak.

Hedge fund managers and those charged with managing pensions have been making deals to engage certain funds managers for pension funds with bribes to the funds managers to hire particular private equity managers. That deal hasn’t worked out so well for pensioners but the managing parties made out like bandits.

Frost’s actions appear to be a bright shiny object, to deflevt attention away from what, herself? Poor returns?

Why does she not just play golf, like many other figureheads?

Is there a Baby Frost who could ger her attention? I’m sure she could micromanage a child up to puberty….

I think that at this stage, even CalPERS Board is beginning to smell a rat. By now they are aware that they are under more scrutiny and that there will be consequences for what they do. And yet Frost keeps on trying to bring back this idea of a private equity model through the back door, through the side door, through a window, through the basement and even the attic. At this stage at the game it is way too late to try doing something as stupid as this and yet she still tries. It’s not funny any more!

If Frost has pinned her reputation on this going through, then it may be time to polish – or in this case embellish – her resume. Her time at CalPERS may be coming to a close. It may be that the Board are not happy with Frost for trying to take them for a ride with this scheme. Being taken for a ride by Frost in this case has only one outcome and I am guessing that the Board are aware of it-

https://www.youtube.com/watch?v=2o1KHpIlCB0

There’s always a tug-of-war when two fight over who holds the reins – the Board or the Staff. Frost and staff have held the reins uncontested for too long to easily cede control back to the Board, imo.

I wish such scrutiny was applied as a general rule.

Is the board aware enough or knowledgeable enough to know what Frost has been doing? She seems to be assuming they are not.

The objective here isn’t returns. The lack of transparency is very clearly the main feature repeatedly being touted by Frost. Why?

After Jerry Brown shut down California’s “Redevelopment Agency” boondoggle in 2011, developer, real estate, and construction interests latched their vampire fangs into CalPERS, who they knew to be in the throes of a leadership crisis and under the influence of a “bent” Chief Investment Officer. The willingness of CalPERS managers to ignore the negative effect of high fees on overall returns has apparently replaced the “skim” that was previously enabled by the 400 “Redevelopment Agencies” that had been established by pliable and easily corrupted city and county governments. Could this be behind the push away from transparency?

Frost’s ignorance of both finance and governance appear to have been the key features of her resume, along with her natural ability to engage in casual lying. When someone finance or real estate starts talking about “innovation” here in the home of Charles Keating, Michael Milken, Angelo Mozilo, and Elizabeth Holmes, I check to see if my wallet is still in my pocket.

Follow the money…

David in Santa Cruz, you take is right on the money in my personal opinion.

…CalPERS is more than two years into its process and is hardly any further along than when it started.

In the case of CalPERS, getting nowhere on this hare brained scheme is a good thing, imo.

And “napkin doodle” plans brings to mind the Laffer Curve. ha.

Thanks for your continued reporting on CalPERS, PE, and pensions.

My thinking exactly. Just like the grand bargain, failure to gain any traction in the implementation of the program can only be a good thing – at least for this Prole.

I wonder if it isn’t private equity that is backing off… they realize Marcie is stupid and they are just coming off of a big defeat in Kentucky. There has been so much CalPERs bad press they might not want to have anything to do with those nitwits. A case could be made that evil private equity duped every last twit on the CalPERs board… and Marcie would be the first to say she was innocent of the whole scam, which could have traction because she is so stupid. Even private equity can’t go that far. Maybe.

Yves,

I’ve heard that everyone involved with this CalPERS private equity plan has zero experience in private equity — that everyone at CalPERS with private equity experience has been shut out. Could you please comment on your understanding?

Also, why do you focus on Marcie, since Marcie is the CEO, not the CIO, and has no investment experience, so isn’t it not surprising that she does not know much about private equity, or any other type of investment? Thank you

As far the plan is concerned, you have heard what I have heard. Recall that CalPERS hasn’t has a head of private equity for now nearly two years and the former head. Real Desrochers, had a cloud over his head in his later days due to having muffed very basic questions about private equity fess from then board member JJ Jelincic. But yes, not only have the private equity staffers reportedly been kept well away from the development of this scheme, even more troubling, so to has been the board’s private equity consultant, Meketa.

As for hanging this on Marcie, Meng is in no position to buck her. He is reports to her, not the board (the CIO was formerly a direct report but the board agreed to cede their power to staff some years ago). For his first year at CalPERS, he is on probation, so the bar for firing him is very low. I am told by a person who was speaking directly to Meng before his hiring was announced that Meng was saying he backed the private equity plan. I don’t see how he could have known enough to have had an informed view, which suggests he thought or was even told that supporting the private equity plan was a condition of his being hired.

Save for when Ted Eliopoulos did a round of media presentations last May, Marcie has chosen to make herself the face of his program, too often literally. Click though to the link for the Top 1000 Funds article and you’ll see her picture prominently displayed. That has been a regular feature of CalPERS communications to beneficiaries (where CalPERS controls the design and the content of the piece) and as you can see, with the press, to use Marcie’s image. The narcissism is so obvious that beneficiaries are calling her “Narcie Marcie”.

More generally, Frost is regularly not only giving comments on investments, she’s been doing so vastly more than Meng has been. Marcie as the CEO is ultimately responsible for investment strategy and she is choosing to act as not just a spokesman, but an architect and advocate even though she is obviously over her head.

Because Marcie is a control freak (common with people who are way above their head). So none of her reports can stand up to her, only board can

If you’re a California resident, here’s a useful reading tip: every time you see the word “underfunded” in reference to CA’s public employee pensions, mentally replace it in your head with “overpromised”. Most of the time, it’s more appropriate and more accurate.

Does anyone on here know Greg Ruiz, the guy that CalPERS hired to head its PE program? I’m not too familiar with Altamont Capital Partners, where he currently works.