A survey of CalPERS’ investment professionals reveals that CalPERS is one big unhappy family. Not only that, it shows that they’ve become less happy in the last year, since Ben Meng became Chief Investment Officer.

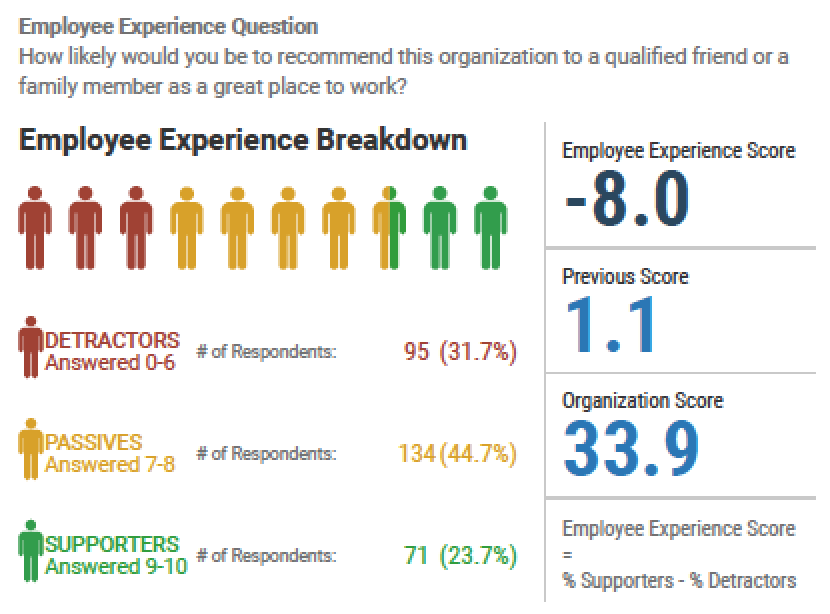

We’ve embedded the summary page of the survey, but this section shows that less than 1/4 of CalPERS’ investment professional would recommend working there to a friend. Bear in mind that 91% of the 329 members of the Investment Office participated, so the results can’t be blamed on sample bias.

Mind you, this level of disillusionment with CalPERS is despite it being a prestigious, yet not terribly demanding hours-wise employer, offering high pay levels by Sacramento norms, and providing generous benefits, from its pension and health plan to its lovely building and upscale cafeteria.

These falling and poor results are particularly troubling since the fetish of large organizations for decades has been to attract and retain talent. The talent at CalPERS is its investment team. These poor scores are damning. They confirm that the key employees recognize that CalPERS is running on brand fumes.

However, these results reflect far more on CEO Marcie Frost than they do (at this point) on Ben Meng. It is possible that disappointment or dissatisfaction with Meng is part of these results, but Meng has not been there long enough to have much impact on CalPERS’ culture.

Recall that one of the justifications for hiring Frost was that she was supposedly a better manager of personnel than her predecessor, Ann Stausboll. That has proven to be as false as Frost’s inflated resume claims. We have gotten vastly more complaints and leaks from insiders under Frost’s tenure than we did under Stausboll’s.

We also received detailed accounts from Frost’s former subordinates at the Washington Retirement System of her self-serving, scapegoating behavior, her consistent tendency to take credit for success and blame staffers for failures (note that this is the opposite of the conduct of high performing leaders, as described at length in Jim Collins’ classic Good to Great). Former Washington Retirement System employees described how the managers in that small system (roughly 250 employees versus over 2700 for CalPERS) were fearful and demoralized.

CalPERS’ investment staff has enough independent expertise and scope for action so as to not be be in Frost’s direct firing line, but the spectacle of her misrule has to be weighing on them. Most if not all had to meet specific educational requirements and often professional certifications as well. Falsifying them would be ground for firing. Yet Frost fabricated her educational and career attainments, both before and even after joining CalPERS, and is still in place. Frost’s stooges then orchestrated the junior-high-school level stunt of wearing burgundy ribbons and clothing at board meetings to show support. If you look at the list of promoters and enthusiasts in the e-mails we obtained via the Public Records Act, you’ll see no one in the Investment Office was a follower. That suggests those employees regarded that exercise with disdain and were secure enough in their positions so as not to feel compelled to kowtow.

Popularity is not the basis for keeping a CEO in place, particularly when weighed against clear evidence of a calculated fabrication that in a well-run organization would be an unquestioned basis for termination.

Frost has also likely not endeared herself to member of the investment office by her repeated nonsensical attempts to discuss CalPERS’ investment strategy. She’s a textbook case of Dunning Kruger effect. It may have worked with Washington Governor Jay Inslee to parrot “lean” bafflegab while actually increasing staffing levels at Washington Retirement System. But the fact that the unsophisticated and largely captured financial press is too polite to call Frost out on her foot-in-mouth moments does not mean they go unnoticed, particularly among actual investment professionals at CalPERS.

And Meng was clearly forced by Marcie Frost to take actions that were at her instigation but put Meng in the unfortunate position of being her bag man, like the still-unexplained ouster of a star hire, Elisabeth Bourqui, or Meng trying to justify and advance Frost’s embarrassingly incoherent and worse, beneficiary-value-destoying private equity “new business model”.

Careful readers of the survey results below might argue that the organization as a whole is more satisfied than the investment team. While true, that is less significant. CalPERS has been described by organizational professionals of having two cultures, of the highly paid, credentialed “eagles” of the investment office (and a handful of other senior executives) and the “squirrels” who handle numerous day to day tasks, like running and manning the call center, handling beneficiary payments and dealing with any disputes, processing payments, preparing financial accounting, running the IT systems, and preparing and mailing beneficiary communications. These two cultures have never sat well together. Frost, who herself is a squirrel who made good, prefers to be, as one beneficiary put it, the CEO of the clerk-typists. Her efforts to win over the Investment Office appears limited to raising the pay and eliminating the investment performance requirements of some top officers. That hasn’t impressed the rank and file; if anything, they may hold their bosses in some contempt for being able to get what were once performance bonuses without exceeding performance benchmarks.

And it likely has not gone unnoticed that Frost has engineered a massive pay increase for herself when nothing at CalPERS is better, and the troops can see that, particularly in areas that unlike investments, ought to be in Frost’s wheelhouse. This example comes from a 2018 post:

We’ve received an unprecedented number of e-mails from insiders praising our work on Frost and expressing concerns about her leadership. Note that only after Frost became CEO did we get intel from current employees, and the level has escalated dramatically since we exposed her resume misrepresentations. This employee e-mail is one of several examples that recited serious internal management failings:

Marcie is over her head. Nice lady but more focused on the politics and giving the appearance that the work is getting done. She relies on and trusts her executive leadership team and they tell her what she wants to hear. Her lack of focus on internal operations and reliance on execs, particularly Doug Hoffner is a mistake. Doug has been there a number of years and has yet to develop any sort of operational plan/priorities for improvement with his chiefs to try and improve their organizations and as you’ve pointed out. (I’ve yet to see or hear a vision from the guy but it’s probably because he doesn’t have an Ops background). Operations, Human Resources and IT are sub-par, lack internal controls, systems integration, workforce planning or future state operating model and all of these programs are under Doug’s watch.

You’ve picked up on the HR hiring issues and the Board elections (under operations) but contracts and IT are bad as well. Operations doesn’t have DGS authority to administer contracts. There’s an old board ordained resolution from the 1990s they rely on using prop 162 as the basis of their authority. They have broadened the contracting type beyond what Dept of General Services allows other agencies (spring fed pool contracts are outside state guidelines. I’m not aware of any other state agency that uses this approach). It seems like DGS, CalHR and CDT should periodically audit CalPERS systems and processes to make sure they are sufficient — don’t think that’s happening….

The place is being run like high school and not like a business.

As Warren Buffett likes to say, when the tide goes out, you can see who has been swimming naked. Perhaps the market downdraft, and the severity of its impact on CalPERS’ funded status, will finally lead to pressure for CalPERS to get a CEO who is up to the task.

00 Investment Office Results

It’s almost soothing reading another instalment of the long-running CalPERS train wreck in these crazy times. Thanks!

+1.

Yves – I agree wholeheartedly with Conrad. Back to mundane corruption that’s not likely to cause massive deaths.

Please check the second sentence of the eighth paragraph. I think you left out a phrase or two. Cut and paste error, perhaps.

Thanks! Actually my internet crashed while I was making final edits…and back only now!

I am shocked, shocked at the idea that a corporate leadership marked by lies, bullying, vote-tampering and the like would have consequences to face over this. You would think that risk-taking young people would be beating down CalPERS’s doors to show off their resume. But it seems that professionals on the scrounge for a job have taken one look at CalPERS and said “Nope”. But there is now a new player on the scene now – Coronavirus. And if Warren Buffett is right, we are about to see a lot of dangly bits.

I can see problems arising over Caronavirus as it hits corporations worldwide. This will really sort out the sheep from the goats and show who will try to get ahead of this virus and take pro-active measures and those corporations who consist of a lot of prancers & dancers. I have checked the CalPERS website and they have a boiler plate notice about Coronavirus and not much more. But sooner or later it will intrude on daily operations, especially when you are talking about a virus that targets older people and an organization that specializes in retirees. I bet that their investments have already started tanking so Marcie will no longer be able to spin this away and have to take action, especially since Coronavirus is endemic to California now.

I can see it now. Marcie will decide to take Coronavirus seriously and doing it the only way she knows how. She will hold a meeting. Not just a normal meeting but a company-wide meeting of all 2,900 odd staff with attendance being mandatory. Staff will have to sign in upon entry to prove they attended but pens will be supplied to do so. To encourage staff to swap ideas and thoughts, seats will be dispensed with and people will be encouraged to mingle to meet with members of other departments to achieve a broad consensus. There will be a chance for staff to meet senior leadership in a meet and greet as well. After the two-hour meeting, staff will be invited to a supplied open-buffet for free which will include a wide selection of finger foods.

The wearing of purple to show unity will be encouraged.

You wouldn’t be surprised to learn that similar corporate leadership is working its magic on the Bullet Train. California specializes in bloated grift, probing and surpassing prior limits of infeasibility and sheer nonsense, worsening with proximity to Sacramento.

Calpers. The gift that keeps giving. Maybe Marcie will be the one to turn the light off after all the staff left?

Unfortunately, I suspect it will play slightly differently – anyone good who is not just-before-retirement will leave, and will be replaced by a court of sycopanths and yes-people. The final bill will go to the Cal taxpayers. Which is why I really really don’t get the complacency of most California tax payers.

This focus on Ms. Marcie is misplaced.

Yes, her resume is a mess. Yes, her management skills are suspect. Yes, she could do better- much better.

It has become obvious that Ms. Marcie is being protected – note that the even the State Treasurer has seen fit to support her.

And so the question must be asked.

The question is there a back channel through which money flows from PE firms to other organizations? Say unions or perhaps politicians?

Premise-

“This focus on Ms. Marcie is misplaced.”

Support-

“Yes, her resume is a mess. Yes, her management skills are suspect. Yes, she could do better- much better.

It has become obvious that Ms. Marcie is being protected – note that the even the State Treasurer has seen fit to support her.”

Conclusion?

“The question is there a back channel through which money flows from PE firms to other organizations? Say unions or perhaps politicians?”

Generally, the premise is supported by facts. The facts cited indicate the opposite is true. The conclusion is in the form of a question. The question marks give it away. You’d fail 5th grade composition with this.

It is false that the State Treasurer protected her. Please don’t comment on CalPERS when you don’t know what you are talking about. The state Treasurer John Chiang called for an investigation of her fabrications about her educational attainment. That strongly suggests he demanded one in closed session and didn’t have the votes but was so upset about the matter that he issued his own press release.

Frost should have welcomed an investigation to clear her name if she were innocent. Her opposition is an admission of guilt.

No, this is CT and reflects a lack of understanding of how CalPERS works.

CalPERS is an inherent governance mess. That results from the legislature in the early 1990s implementing changes to the California constitution that effectively made CalPERS accountable to no one.

Over the years, staff has succeed in capturing its once independent and highly competent board. You’ve seen us play numerous clips of the staff presenting utter hogwash to the board and being openly intransigent, like refusing to “bring back” (as in respond to at the next meeting) matters raised by board committee heads (ie by the supposed power faction).

Put it another way: do you seriously think Henry Jones could ride herd on Marcie, even if he were inclined to do so?

Rob Feckner, the long-standing prior board president, was a credible imitation of a potted plant. Priya Mathur was a better show pony but she was owned by staff due to them protecting her during her numerous scandals (campaign finance violations among other).

The state of play at CalPERS exists at just about every other US public pension fund: weak rubber stamp board manipulated by staff. It’s just more embarrassing at CalPERS because it was once a competent, well respected organization and showed it didn’t have to be this way. CalSTRS has a much better board that actually asks serious question and manifests some understanding of investment issues (even though its board is also ultimately deferential to staff), proving that public pension fund management does not have to be a train wreck.

While I strongly disagree that the focus on Ms. Frost is misplaced, there absolutely is a back-channel through which money flows from PE firms, and more importantly RE firms, to the politicians. The unions and lobbyists are part of the back-channel, but they only benefit collaterally. It is the politicians who need the money in order to hop from term-limited lily pad to term-limited lily pad.

The circumstances that have been reported publicly inevitably lead an objective reader to conclude that ex-board member Al Villalobos blew his brains out rather than turn snitch, and that ex-CEO Fred Buenrostro pulled a weak-tea “Frankie Five Angels” and is serving a much longer sentence rather than turn snitch in order to protect powerful players. CalPERS and state Attorneys General Brown, Harris, and Basura have not lifted a finger to recover the tens of millions promised to be disgorged by the sources of the “placement fees” that were sloshing around in shoe boxes, and the board and counsel appear to be more interested in maintaining a cover-up than in recovering the losses.

The presence of a little-respected high school graduate from the Washington rainforest as a cheer-leading CEO ignorant enough to be able to lie with a straight face is the aroma of a fish rotting from the head — and worthy of the excellent reporting here at NC.

Follow the money…

This is off point.

There is zero evidence that PE had anything to do with Frost’s hiring or her continuation in her role. They don’t need to slum like that. Heidrick & Struggles did a search and you can infer from the records I obtained by PRA that they had a great deal of difficultly finding anyone who wanted the job. That is a sign of how much CalPERS has fallen

We have written at length that the STAFF is captured, not just at CalPERS but at public pension funds generally. There is a widespread urban legend that PE firms can get staff members fired, when the sole case in 35 years of public pension fund investing used to support this hypothesis is very much misconstrued.

Similarly, PE staff at public pension funds (and some PE pros do make vague noises to support this deeply misguided view) have conned themselves that 1. They might get hired by a PE firm (there are so few examples of this happening that you can count them on one hand and have fingers left over…and the people hired had Ivy undergrad and grad degrees or equivalent) and 2. a PE firm would given them a referral in a job search.

The staff are further captured by the soft bribery of lavish annual PE events (paid for out of public pension fund money!) in glam locations, with gourmet meals and top tier entertainment (Rolling Stones/Elton John level).

Yves, my friend, I think that you misunderstood my comment above. I agree with your analysis of “soft” staff capture.

However, it is the politicians who control the CalPERS board and top management, not the PE, RE and health firms money is deployed to. No investment professional worth her or his salt wants to operate in an environment where politicians — especially in a single-party state — want to call the shots on whether funds are deployed with favored managers.

If you scratch the PE, RE, and health firms around the land, you will find that they are quite generous with political contributions and charitable donations to causes favored by the politicians and their cronies. Some of these beneficent gifts are laundered through a shell-game involving unions and federal office holders.

Strange that no one complained about conflicts of interest when Feckner’s union boss was simultaneously being massively compensated as a lobbyist for a health firm negotiating with CalPERS — while also employing Feckner’s wife at a six-figure salary. Strange that a well-connected lobbyist who didn’t have two nickels to rub together 15 years ago now deploys $13 billion in public pension RE investments through his firm, and easily has laws changed to accommodate his predilection for gaming and redeveloping horse tracks.

It is the politicians who most desire the levels of obfuscation enabled by a blissfully uneducated CEO, not the PE, RE, and health firms who also benefit. It is the politicians who control CalPERS.

Follow the money…

Plausible deniability. It’s why Homer Simpson was hired as the head of a nuclear power plant.

No, this is nonsense. See my comment above.

Damn! I was hoping for an actual indictment, by a grand jury.

Those survey results scream “toxic workplace”. wow.

Thanks for your continued reporting on CalPERS, PE, and pensions.

Yves it is good to see the results of that survey in print. There are sub groups within the investment office where the employee experience score is even worse. In one case it is – 44 in fact and that by the longest tenured MID in the investment office who is one of Meng’s key sycophants.

The odd thing in all this is how you let Meng off so lightly. He’s charming and very political but to call him as Marcie does “a renowned international investor” makes me laugh. In his previous tenure at CalPERS he ran no portfolios in the Fixed Income department. When he moved to Asset Allocation the things he was visibly involved in were a complete disaster – eliminating the fund’s currency hedge at exactly the wrong time and bringing hedge funds back into the organization through the back door through the MAC partners program after they’d been kicked out the front door. MAC was a disaster. To get the job he did in China through whichever means he secured it certainly was not based on his success at CalPERS.

Upon his return to CalPERS where he is getting paid $1.5 million, twice his predecessor’s pay, his great accomplishment has been to turn the public markets exposure into an index fund while proclaiming the need to do more and more private equity. Makes one want to cry. CalPERS PE exposure is 7% and falling. They can’t even keep a relevant share of the fund invested in it. Probably just as well because if you looked at CalPERS PE returns versus the S&P 500 you’d have to ask what’s the point.

Meng’s great strength is his political skill. Marcie’s failing is that she let Ben pull the wool over eyes.

As I said, Meng has not been in office long enough to have pulled managerial levers to account for the decline in morale. And Meng is not responsible for his pay package, if that is what you are attributing it to. It is Marcie who led the hiring process, which included recommending him to the board and pushing for the greatly increased CIO comp, which then served as a basis for increasing her and other senior staff pay.

Your allegation is that Meng is overpaid and not all that good. I’m not disputing that. But the blame for that lies with Marcie for installing him as CIO.

Yu (Ben) Meng donated to CalPERS Board member political campaigns, including $500 to CalPERS Board member and State Treasurer John Chiang in April 20, 2018, conveniently shortly before prior CIO announced his retirement May 14, 2018, the last of several of Yu Meng’s political donations to John Chiang. Meng also donated heavily to Fiona Ma, who replaced Chiang as CalPERS Board member and CA Treasurer.

You don’t need to believe me. See for yourself at the CA Secretary of State website dbsearch.sos.ca.gov or other public websites

Some of Yu (Ben) Meng’s political donations are copied below — of course none had anything to do with why he was offered the CIO job

Political Contributions (Donations) made by Yu (Ben) Meng

Recipient Office Date Amount Meng’s Employer

John Chiang CA Governor 4/20/2018 $500 calpers

John Chiang CA Treasurer 6/23/2012 $500 CalPERS

John Chiang CA Controller 10/20/2010 $500 CalPERS

John Chiang CA Controller 10/22/2009 $250 CalPERS

John Chiang CA Controller 5/13/2009 $250 CalPERS

Jason Hodge CA Assembly 4/12/2012 $250 CalPERS

Jason Hodge CA Assembly 6/15/2011 $500 CalPERS

Fiona Ma CA Assembly 7/16/2010 $300 CalPERS

Fiona Ma CA Assembly 12/9/2009 $300 CalPERS

Fiona Ma CA Assembly 10/4/2008 $100 Barclays Global Investors

Fiona Ma CA Assembly 11/1/2007 $250 Barclays Global Investors

Fiona Ma CA Assembly 3/3/2007 $300 Barclays Global Investors

Mike Honda House of Rep 3/11/2013 $250 CalPERS

Mike Honda House of Rep 4/15/2010 $250 CalPERS

Barack Obama President 10/25/2012 $500 CalPERS

Steve Hansen CA-SMF City Council 2012 $100 CalPERS

Sorry, this proves nothing. The board didn’t hire Meng. Marcie did. He’s a direct report to Marcie.

In fact, given that Chiang had the temerity to push for an investigation of Frost after one can infer that the board had rejected him (and maybe other) pushing for it, that is hardly in his favor.

Meng is not a bundler, didn’t host big ticket fundraisers. His donations are at the nothingburger level in the political realm.

Stop making trying to make this about Meng. Any organization expert will tell you the CEO is far and away the most responsible for an institution’s culture. They control who gets hired, what people get paid, who gets promoted, how serious or lax they are about compliance, etc. Meng is just not as important as you want to make him to be except as a symbol of Marcie’s bad priorities.

No No No on conspiracy theories.

Marcie was hired by the Board but not because she was an amazing candidate. She clearly did not meet minimum standards and the Board eliminated some important requirements like education.

Narcie Marcie got the nod because the Board had to scrape the bottom of the barrel. It appears she really was the best candidate because no skilled CEO wanted to pollute his/her resume with a stint at the corrupt, low performing CalPERS.

Yves I agree that Ben’s return is recent but many of us here worked with him for years on his first go round. Staff who worked for him as well as those at his level who worked with him will tell you did he did not leave here to go to China with the best reputation either in terms of his work output or his sincerity. So many of us had our jaws drop when he was appointed the new CIO. While I was unaware of his political donations it is entirely consistent with his political approach to things. Marcie would of course have been star struck that he went to SAFE as it gives him credentials but his job there was external manager relations not portfolio risk taking. Due diligence and honesty are not fortes of CalPERS. We all hope for the best here but experience has taught us otherwise. The fact that engagement survey results for the investment office since he arrived have gone down from an already low level despite his relentless internal charm offensive should tell you that we don’t like what we’re seeing and experience has made staff skeptical.